Assess and Win Competitive Deals With Data & AI

DDVC #40: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 10,401, +216 since last week

Brought to you by Affinity - Insights you need to find, manage, and close more deals

Download the 2023 Investment Benchmark Report: European Edition to discover key benchmarks to set your firm up for success. Plus, learn how strong relationship intelligence helps European firms utilise their networks to source, research, and close the highest quality deals.

Last week, we explored how data-driven approaches provide unique LP leads for your next raise as a fund manager. Following this effort to showcase how innovative approaches change the VC value chain all across, I’d like to focus today’s episode on the deal-winning process that spans the due diligence and closing stages.

What characterizes a “competitive deal”?

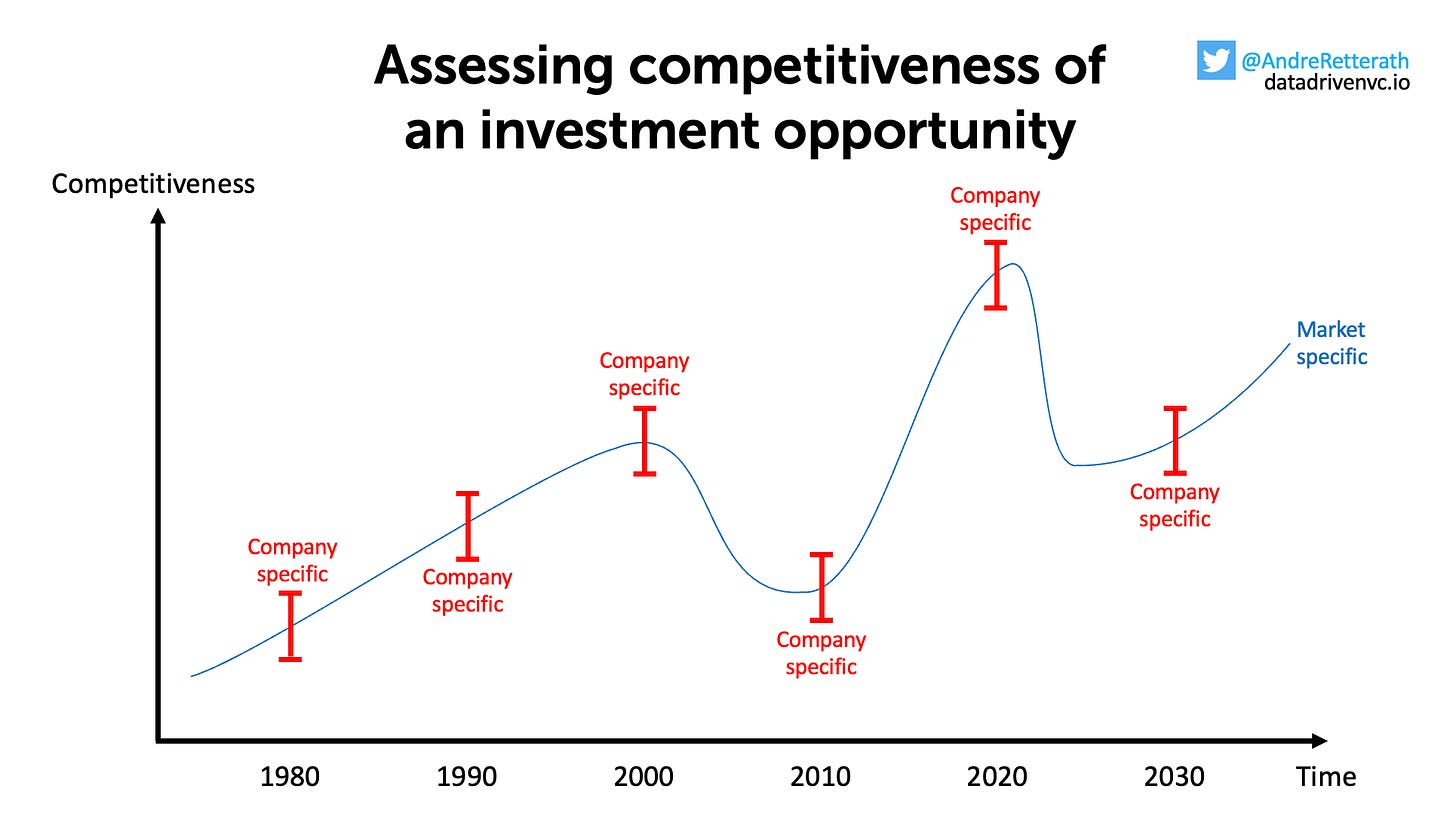

Competitiveness from an investor’s point of view is a function of the supply of investment opportunities and capital to be deployed (=dry powder). In my mental model, I split competitiveness into two components:

Market-specific part: It’s the more macro level that compares competitiveness over time. This “market baseline” is the result of ALL available investment opportunities IN THE MARKET and ALL available dry powder IN THE MARKET. The less (more) opportunities, the more (less) competitive the market. The more (less) dry powder in the market, the more (less) competitive the environment. Ceteris paribus for both ofc.

While we’ve seen substantial effacements of VCs between 2000 and 2010 (and let’s see what happens in the next few years..), the average market baseline seems to continue to move up and to the right as a consequence of overall more capital inflow versus a steady number of relevant investment opportunities. Generally, VCs should keep a close eye on this baseline as it defines the required alertness and reactiveness when spotting a promising opportunity. Have heard a VC mentioning that this year is so much slower in deal flow than the previous years? This is what I’m talking about ;)

Company-specific part: This is the more micro level that allows us to compare all opportunities at a given point in time. It’s the result of the “hotness” of a company and the dry powder chasing this specific company. The “hotter” (weaker) the company, the more (less) competitive the investment opportunity. The more (less) investors have this company on their radar, the more (less) competitive the deal becomes.

While “hotness” is a function of fundamentals and hype (worth noting that VCs are prone to herd mentality..), capital chasing a specific opportunity depends a lot on the point in time of a fundraising process. The earlier an investor gets in touch, the less competitive a deal is. This is why superior sourcing and screening approaches are of utmost importance. Independent of the market-specific level, hot deals will always become competitive.

As stated in my “The Future of VC” post in 2020, early identification is a great differentiator today (likely also tomorrow) but will fade in the long run as more VCs will understand and leverage the power of data-driven approaches and AI. Therefore, I’d expect the access component to become increasingly important.

The time between a growth signal and an initial meeting will decrease across the industry. A promising growth signal, be it a jump in Github stars or Upvotes/“Hunt of the Day” at ProductHunt, might lead to several automated “Hi Founder, let’s speak! Choose a slot in my Calendly here”-emails from VCs.

In this extreme (but IMHO likely) scenario, access to deals will become increasingly important as most investors will compete for very few high potential deals — at (more or less) the same time. Clearly, not all of them will be able to invest. While historically the best VCs could choose which founders they wanted to work with, today and even more so in the future, it will be the other way around: the best founders can choose which VCs they want to work with.

What does it take to win a competitive deal?

As highlighted in my Future of VC post, it takes (1) a sufficient fund size (which means that ceteris paribus you can pay a higher price per company for your target shareholding) as well as (2) a superior firm and personal brand.

As the VC industry becomes more efficient, two “access components” will become core: capital availability (which VC is able to pay the highest valuation) and VC brand (firm brand + personal brand of the individual investor) — besides personal fit (which will remain key)!

Today, a few years after writing the above-mentioned piece, I’d add

(3) Efficient, effective, and transparent processes, to properly get to know the founders and conduct due diligence without overwhelming the team with requests and interactions. I’ve heard from many founders how intransparent the majority of VC processes are and that clarity end-to-end is a big plus. The more work you can get done in a limited period of time, the stronger your conviction as an investor can become.

(4) Expertise and relevant experience to talk at eye-level to the founders and convince them you’re a great companion for their journey. It’s the basis for proper alignment on things like strategy, positioning, and many other factors.

Many may argue that the toolbox of a good venture capitalist should be transferable from one vertical to another or from stage to stage. They may also claim that the breadth of knowledge acquired across these varied sectors and stages provide them with additional perspectives and advantages, such as knowing what the startup should look like in their next funding round or what approaches have and haven’t worked in other sectors. This may be true.

But ask yourself: Would you prefer your heart surgeon to have spent the last 15 years gaining experience in wisdom teeth removal and physiotherapy or mainly focused on heart surgery? Clearly, there is a balance, and even the best heart surgeons spend time in other disciplines to derive inspiration. But at this point, venture capital is in the process of moving from a "one doctor treats all" attitude to one that is more focused on specific stages, verticals and geographies. (source: Why VC Specialization Is Good For Founders And Investors As Markets Mature)

(5) Signs of value add even before the investment to showcase what a post-investment collaboration might look like. This includes intros to potential customers, intros to triple-A candidates to fill open roles, or intros to contacts in other geographies for expansion plans.

Looking at a study from Atomico from 2022, my top 5 factors above seem to tick most boxes on why founders chose to work with VCs (right column in the graphic above).

How to leverage data & AI to win a competitive deal?

Data-driven approaches and AI help you up your game across (3) processes, (4) expertise, and (5) value add. Some powerful examples:

A single source of truth that contains all publicly available data allows you to properly prepare your intro meeting in minutes (versus days, which no investor has - so in reality rather comes unprepared into meetings that are topic-wise out of his comfort zone) and ask the right questions. Eventually, this will speed up preparation and leave a great and well-prepared first impression, i.e. positive impact on (3) and (4)

Automated competitive landscapes based on the similarity of word embeddings (based on descriptions, website scrapes, or any other form of information around the company) allow you to see all relevant players at a glance and challenge the founder on their positioning right away. Again, this will speed up preparation and early due diligence while at the same time leaving a well-prepared impression. Moreover, sharing such comprehensive insights directly with the founders can be highly valuable for them and an early sign for value add —> positive impact on (3), (4), and (5)

Metrics benchmarking based on a single source of truth database allows to cluster similar companies into peer groups and compare them across publicly (and after direct exchange oftentimes also privately) available information such as website traffic, news mentions, and sentiment but also hard metrics like absolute revenue, growth, margins, CAC, LTV, and a lot more —> positive impact on (3), (4), and (5)

Graph-based CRM systems allow you to visualize your relationships and easily find the best path for introductions. Just ask the founders for their customer wishlist, find the best relationship to the right person within the target organization, and request an intro to the founder with LLM-generated emails in seconds to prove early value add —> positive impact on (3) and (5)

A talent database that contains all relevant mid- to senior-level people profiles that are searchable based on their location, expertise in a specific industry or function, and strength of a relationship with someone in your team. Hereof, you can present promising profiles to the founders, collect their responses to the recommendation, and continuously improve the system. Looking for an HR leader with EdTech experience in Munich? We have you covered. Essentially, an ML-based LinkedIn Recruiter on steroids —> positive impact on (5)

…

At Earlybird, we’ve been working on the above and many other ideas to improve our capabilities to win competitive deals. How do you think VCs can become more competitive?

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

no doubt that the time between a growth signal and an initial meeting will decrease across the industry

Hey Andre! We would love to meet with you about featuring our data. What's the best way to get in touch?