Data-driven VC #18: What ChatGPT means for the future of startup funding

Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 4,643, +583 since last week

I’m incredibly excited to welcome more than a thousand new readers who joined in the last 10 days. Wow! 🤯 I was aware that productivity has gained significant importance for VCs but didn’t expect my 10x Productivity with ChatGPT post hitting such a nerve. I seemingly underestimated how many of you share the pain of inefficiency and the urge to free up time for more important levers of your work.

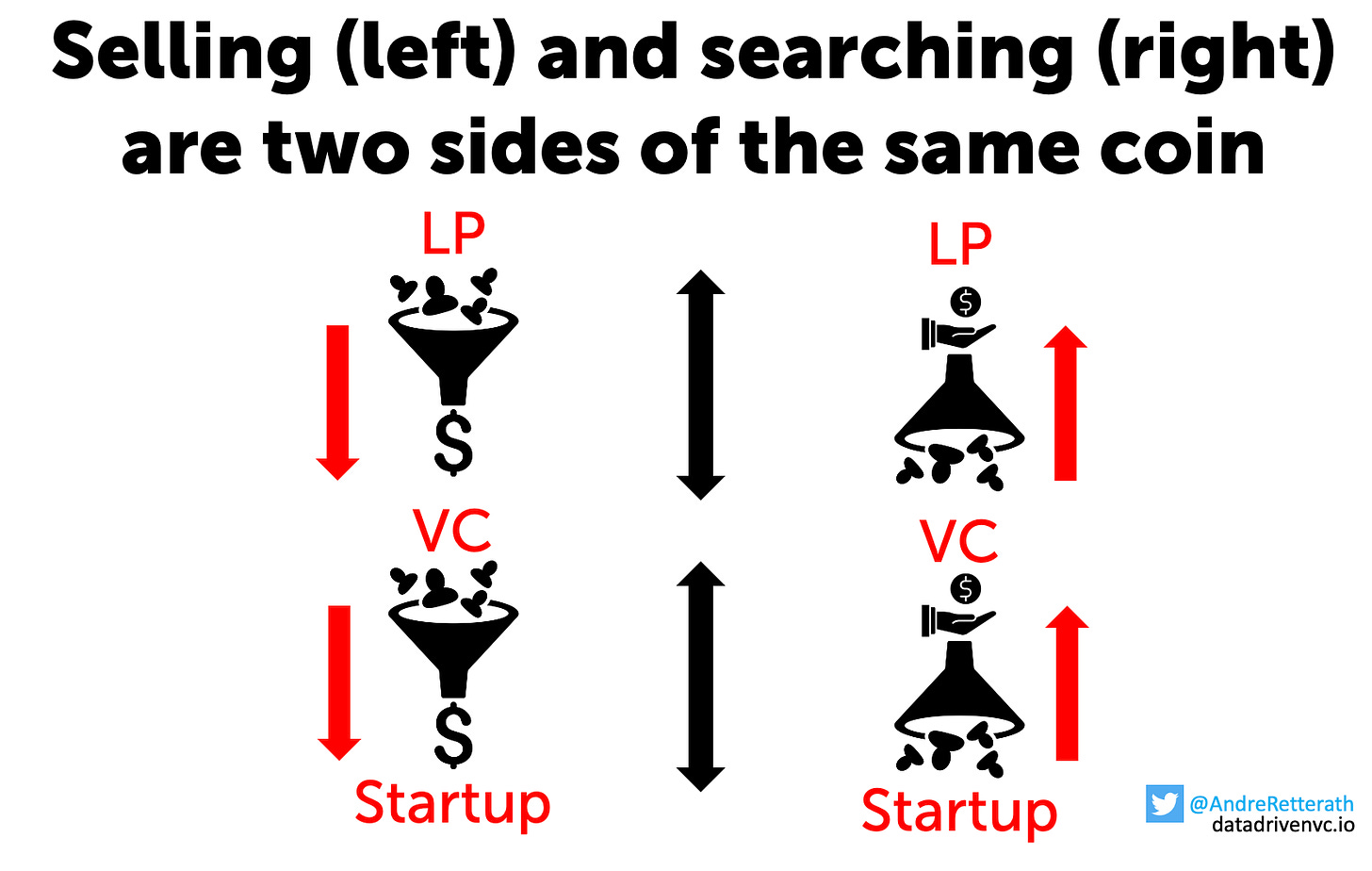

VCs and founders are two sides of the same coin

Following last week’s post, many of you have asked me about my thoughts on the future of startup funding and the impact of ChatGPT / Large Language Models (LLMs) on our job. I like to dedicate this post to sharing some thoughts on why and how LLMs / AI will change the game for all of us. It is important to note that for the majority of statements below, LPs & VCs as well as VCs & founders share the same processes but sit on different sides of the table.

For example, startups raise money from VCs in exchange for equity. Fundraising is a sales job, so startups need to build a “sales” funnel and convert potential VCs to invest in their company, see bottom left quadrant in the above graphic. Same process but on the other side of the table, VCs need to create superior returns by investing in the best companies. Therefore, they need to create a “search” funnel to identify the most promising startups and get the opportunity to invest in them, see bottom right quadrant in the above graphic.

In a perfect world, the initial matchmaking (overlaying both funnels) would be fully automated based on comprehensive data availability and cross-checking of each other’s criteria. As a result, both parties would receive a pre-qualified selection of high-potential partners whom they could extensively meet and interact with to validate fit on the human level, to sit together, look each other in the eyes and say with confidence “We want to do this together".

In reality, however, it’s completely different. Humans spend most of their time researching and creating a manual funnel, having numerous back-and-forth interactions (that are frustrating for both sides and provide little/no insights on each other’s personalities, values, norms, drivers etc.) to collect all necessary data and eventually find out that 95%+ of the potential partners on the other side of the table don’t match. Majority of time wasted with the wrong tasks and opportunities to then be rushed into the interactions with the remaining high-potential candidates and being forced to make a go/no-go decision with insufficient confidence. Suboptimal, I’d say..

Wouldn’t it be nice if we could automate the first step of the fundraising, i.e. the matchmaking, to then, in turn, have more time for the second part of the fundraising, i.e. the human interaction?

The solution is an “augmented VC”

With a clear answer to the above question in mind, I shared a post “The Future of VC: Augmenting Humans with AI” in December 2020 that has proven to be a good prediction of what happened to accelerate through ChatGPT / LLMs in the course of 2022 and beyond. The following extract briefly summarizes my core beliefs:

An “augmented approach” is a hybrid between humans and machines. Data-driven sourcing tools help VCs to move closer to comprehensive coverage and ML-based screening tools narrow the upper — steadily growing — part of the deal funnel to a constant number of investment opportunities.

As a result, investment professionals could save substantial time spent on less promising opportunities that could then be focused on properly evaluating a pre-selection of high-potential ones. They can use the freed-up resources to build stronger relationships with the selected entrepreneurial teams and to put themselves in a better position to secure the most competitive deals.

Instead of going broad and shallow by allocating limited resources to an ever-growing number of opportunities, the use of ML-based screening tools frees up time and allows a venture capitalist to go narrow and deep on a selected number of opportunities while still ensuring that promising deals are not overlooked. It’s a win-win for entrepreneurs and investors alike as both sides can get to know each other better.

Continuing this line of thought, ChatGPT / LLMs will be a fundamental part of the stack driving startup investing into more efficiency, effectiveness and inclusiveness. I’d like to dedicate the remainder of this post purely to ChatGPT’s / LLMs’ impact on these three dimensions.

1) Efficiency

As the title suggests, last week’s ChatGPT PRODUCTIVITY post was mostly centered around efficiency, i.e. improving input-to-output conversion or, said differently, reducing the time spent to achieve a specific outcome. I explained in detail how we achieve an efficiency improvement with the help of ChatGPT / LLMs and other tools like Zapier. As a result, we can free-up time for other, more valuable but also more difficult to automate, parts of our job, like meeting founders in person and actually spending time together.

Having integrated some of the described examples like (website) data extraction, call transcription, translation of all text into English, notes summarization, company classification across industries and technologies, similarity analysis as well as email and content drafting (btw the headline of this post got drafted by ChatGPT) into my daily workflows, I can confidently say that it frees up 90%+ of the time compared to the respective manual execution. For many tasks, I can already automate 99.9% whereas for others I take the model response as a draft and fine-tune it manually before submitting it to the next stage. So overall easily 10x productivity increase.

A great benefit of this newsletter is your feedback. After last week’s post, I received a so far unseen amount of DMs with new workflow ideas and links to other ChatGPT examples revealing the vast efficiency improvement potential for all of us.

Unfortunately, these prompts are widespread across the web from Twitter threads over blogposts to YouTube videos. This made me think if a targeted prompt database (easily accessible in Notion) for VCs and/or startup founders could be of value. What do you think?

Feel free to write additional thoughts in the comments below. I personally started to save and tag all useful prompts for better searchability and would be happy to share it with you. In return, I’d be interested if you’d also be willing to contribute your prompts and accelerate content growth through our community.

2) Effectiveness

In addition to efficiency, I’m strongly convinced that ChatGPT / LLMs will make VCs more effective. Why? Well, we come from an era of big data where everything got tracked and monitored but eventually resulted in a big mess with a minority of the data being leveraged. Just think about the vast amounts of documents and data stored but not used at all in your company. AI and advanced search will enable us to finally make sense of this jungle. ChatGPT / LLMs make the right data accessible at the right point in time to inform better decision-making.

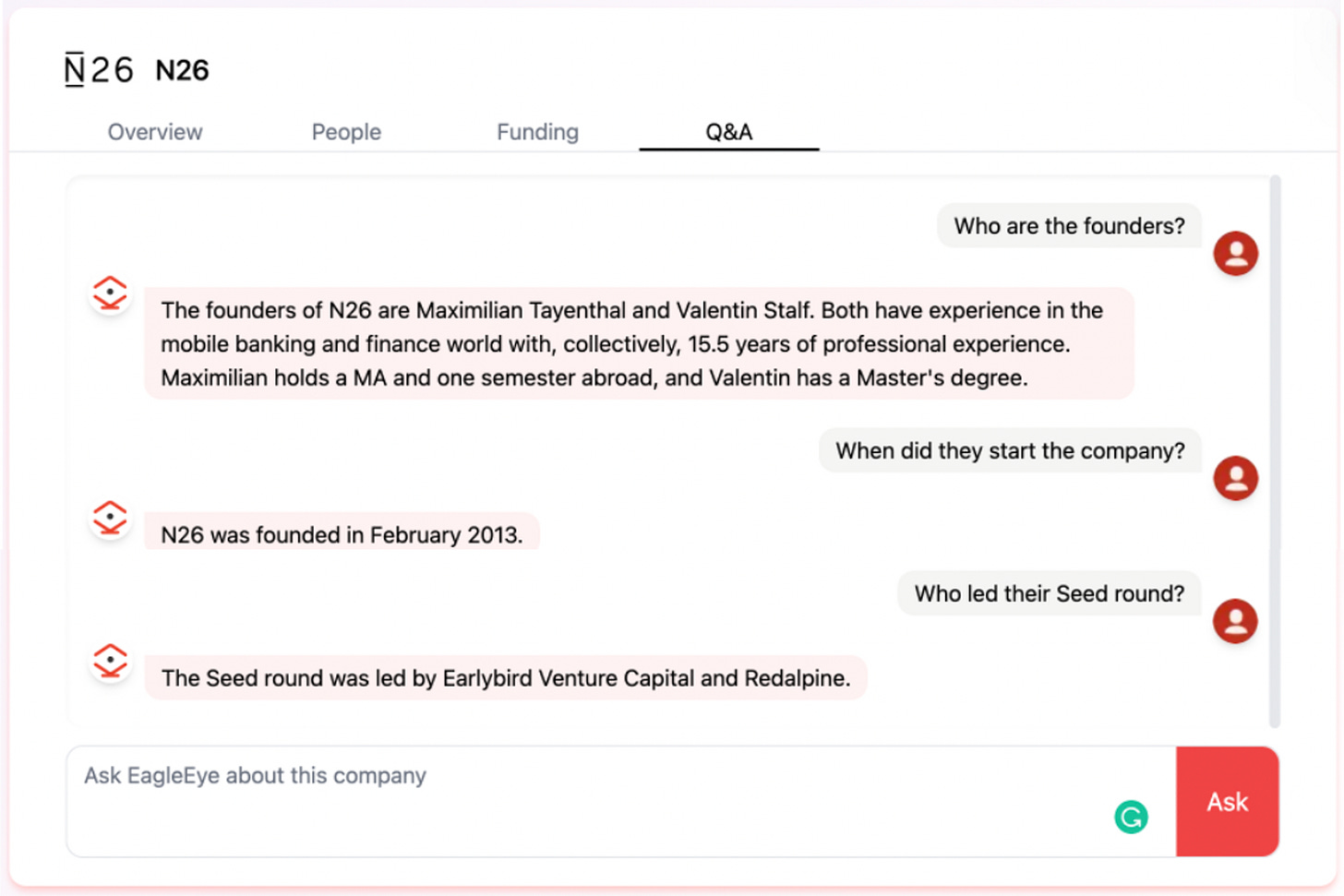

To make this claim more tangible, I shared an example in last week’s episode where we at Earlybird integrated LLMs into our startup database and can now interact with it just like with a human assistant.

Another great example of an advanced search integration was shared here by Asta Li. She created a GPT-3 interface that allows her to query SEC filings and find relevant information with ease. It’s really a game-changer and while LLMs catapult efficiency levels through the roof, they have a similarly strong impact on effectiveness as decision-makers can finally access and consider data that they previously didn’t even know of. It reduces the unknown unknowns and increases the amount and quality of information used to make a decision.

For VCs, the integration of advanced search models into our proprietary databases will likely be an addition to our existing dashboards that accelerates the adoption of data-driven approaches in our decision-making. It will help us to become more objective and reduce biases which in turn will likely improve fund performance. Yes, the impact of LLMs on efficiency is easier and faster to measure than the impact on effectiveness, but I will certainly come back in a few years from now, once we’ve collected the performance data, and validate this hypothesis :-P

3) Inclusiveness

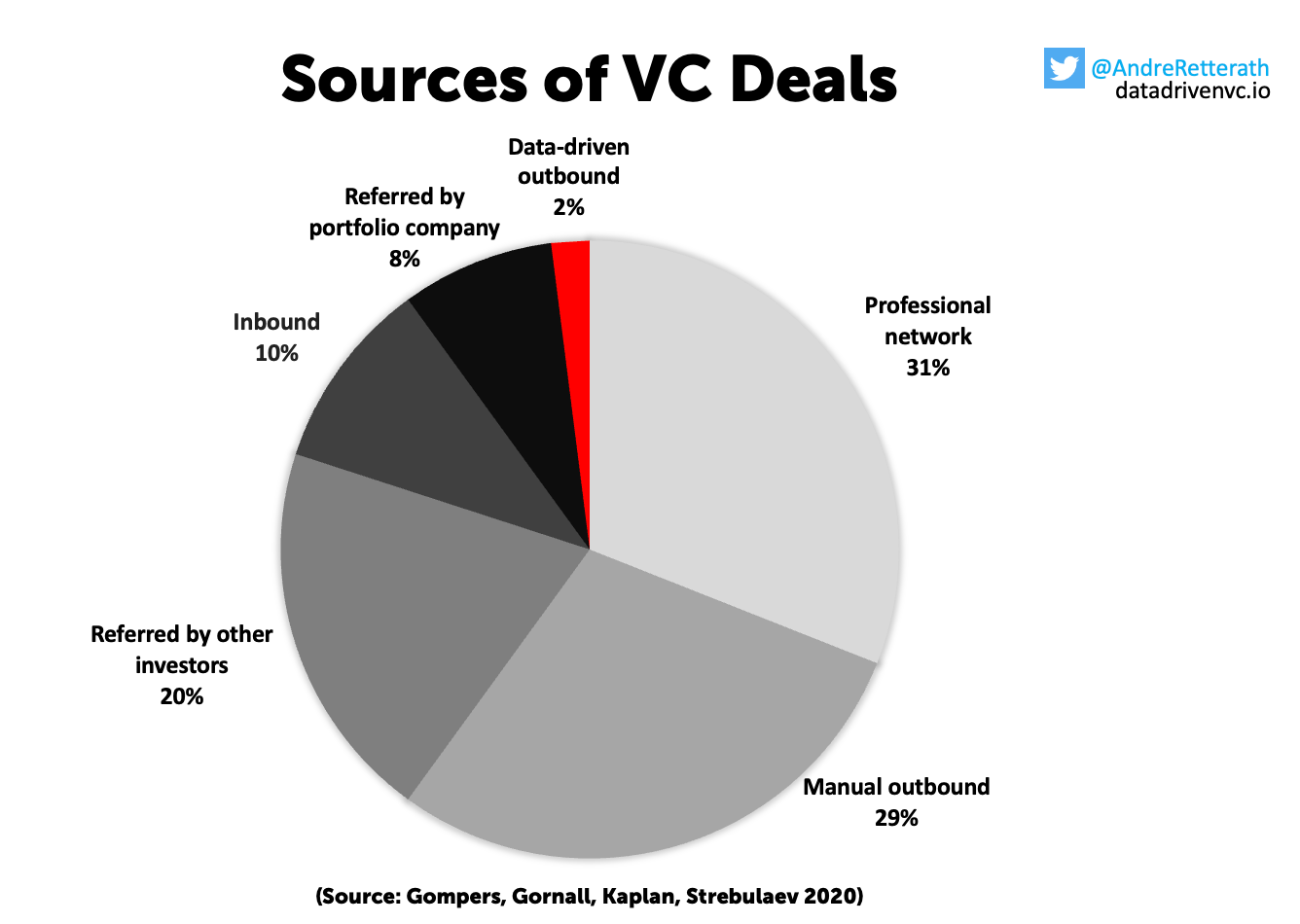

You know it, I know it, we all know it: Access to venture capital is highly exclusive and associated with significant entry barriers. It’s more than anecdotal evidence as proven by a range of academic studies. The figure below depicts the findings of a 2020 study by Gompers, Gornall, Kaplan and Strebulaev.

While only 10% of deals come inbound without an intermediary, a total of 59% (!) of VC deals originate with a warm introduction through professional network, other investors or an existing portfolio company of the VC. Unfortunately, not every founder has access to a benevolent well-connected intermediary and, therefore, their chances to access VC funding are visibly lower compared to their peers.

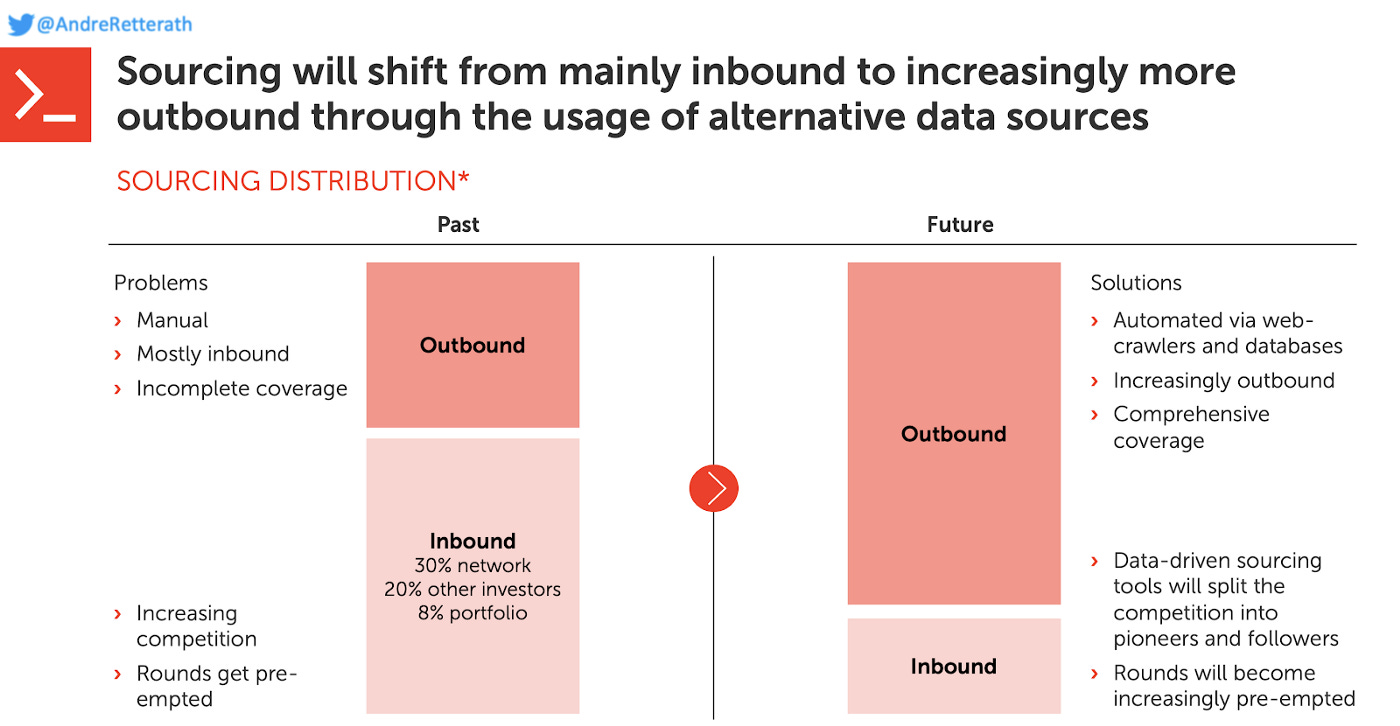

To summarize the status quo: “Talent is distributed equally, opportunity / access to capital is not.” Data-driven approaches are here to change this. Although only 2% of VC deals got classified as “Quantitative sourcing” in the 2020 study above, I’m convinced that this number will continue to grow and is about to accelerate as described in my post and the graphic below.

LLMs will certainly accelerate this transition and the adoption of data-driven approaches by technically less sophisticated investors. ChatGPT reduces the entry barriers for investors to leverage LLMs and automate data extraction, processing and accessibility. It significantly improves the matchmaking between VCs and startups. As a result, capital can be allocated to the founders who are best positioned to build an outlier business with true impact, with or without warm introductions.

The need for preferred relationships should gradually disappear as investors will be able to get full transparency on the startup ecosystem without intermediaries and navigate the data to identify the most promising opportunities more easily. The use of LLMs in combination with other data-driven approaches will democratize startup funding and make it more inclusive and accessible.

Evolve or die

I vividly remember the many conversations on digitization and the evolution of data-driven approaches in VC I had as part of my research in 2017. The majority of VCs was strongly convinced that VC is more art than science and that our industry would be spared from digitization. Funny. Few years later, one must be blind to not see the obvious. VC, as any other industry, is undergoing a transformation driven by AI.

The bigger the firm in terms of AUM and money deployed per year, the bigger the impact of AI and data-driven approaches will be. Only micro and boutique firms will be able to stay competitive without a sophisticated tech stack as they can rely on their proprietary networks and don’t need to make a lot of investments. They don’t need comprehensive coverage whatsoever. This is different for big firms. For them it means evolve or die.

As Fred Wilson from Union Square Ventures has nicely framed it “We cannot put this genie back in the bottle (..) use these tools rather than pretend they don’t exist.” This statement very much applies to VCs, founders and any other knowledge worker: Use these tools rather than pretend they don’t exist. Others will do it for sure.

Will AI kill the analyst?

I don’t think so. Instead of killing jobs, I think AI will create a massive opportunity and number of new jobs with different skill requirements. In VC, this trend can be observed by looking at the rapidly growing Engineering teams all across (stay tuned, the “Data-driven VC Landscape 2023” will have the details for you). I believe that investment professionals will spend less time with stupid monkey work (data collection, data processing, modeling, sliding etc.) and have more capacity to properly think and learn. To elaborate hypotheses. To understand markets and products. To spend more time with the founders and actually support them instead of “trying to be helpful”. To learn from their peers and just be more human.

In Summary, ChatGPT / LLMs will make all knowledge workers, and more specifically VCs and founders more efficient, effective and startup funding overall more inclusive. It will allow us to automate the majority of our workflows and access the right data at the right point in time to make better decisions and eventually spend more time with the most promising opportunities. If used wisely, this technology will allow us to allocate more time to the things that really matter and outperform our competitors that lack behind in its adoption. What’s your perspective?

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

Thanks for the thougthful analysis! Just wondering whether AI can really replace a recommendation from a professional network. Network recommendation means: someone actually talked to the start-up, they were able to hold up a conversation, and the person was convinced that aside from the tech that the start-up has (or doesn't) the team is somewhat organized and has at least a slim chance of success based on the way they work together. There is a lot of emotional intelligence involved here, and I doubt that AI will be able to replace that in full.