Why Do KPIs Matter? The Most Comprehensive Guide on What it Takes to Raise a Growth Round

DDVC #52: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 13,115, +110 since last week

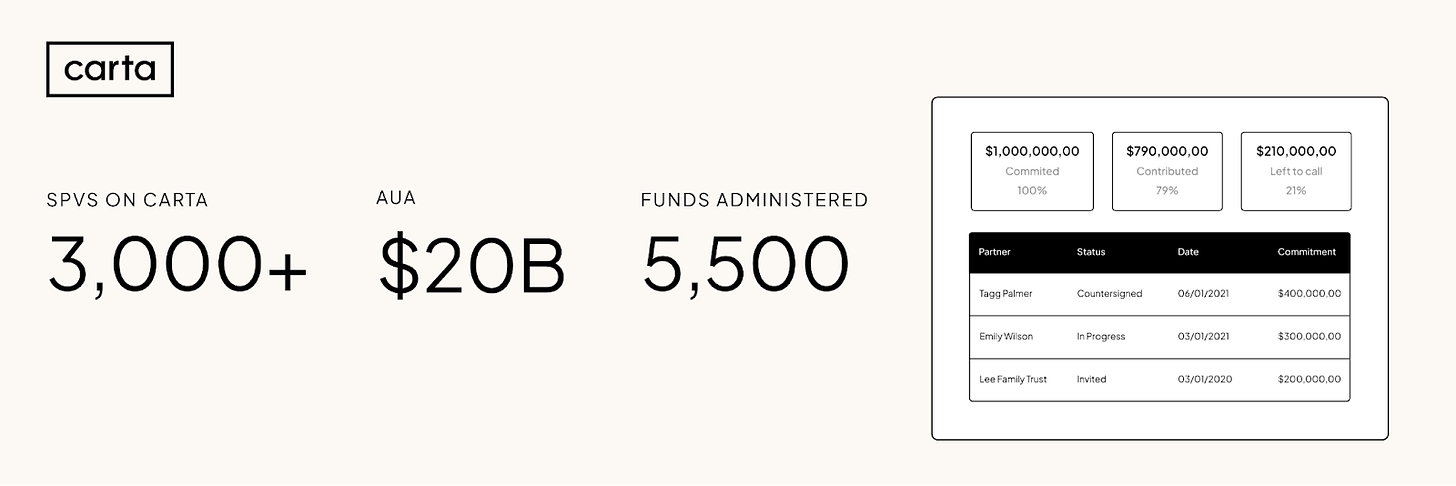

Brought to you by Carta - Your Equity Management Solution

Carta is a platform that helps people manage equity, build businesses, and invest in the companies of tomorrow. Our mission is to unlock the power of equity ownership for more people in more places. Carta manages over two trillion dollars in equity for over two million people globally. The company is trusted by more than 38,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity, venture capital solutions, and more.

Hot Off the Press!

I’m excited to share “The Series B Blueprint: A Guide for Early-Stage Founders”, the result of a strong collaboration between our team at Earlybird and our friends at XAnge aiming to provide the most comprehensive summary of what it takes to raise a successful growth round. In light of my work around Data-driven VC, I was lucky to contribute the probably most data-driven part of the project: Startup KPIs.

Why Do KPIs Matter?

KPIs play an essential role in the life of early- stage founders and investors. They are often the best indication on the surface level of a business’s underlying operational health. So it is helpful to understand from which perspective a potential investor will look at metrics – before and after an investment.

Pre Investment

Analyzing a start-up’s KPIs is a crucial part of the screening and due diligence process, providing the basis for informed decision-making. Depending on the stage of the initial investment, our evaluation criteria range from soft factors like team or value proposition assessment over more product-related metrics like usage or retention to commercial KPIs such as topline growth, unit economics or net dollar retention.

Showing one’s past achievements through meaningful KPIs can help a founder stand out among the high volume of pitches an investor looks through on a daily basis. It also lets the investor benchmark opportunities in a straightforward and objective manner. A classic quote within the Earlybird team is: “Traction never lies” - meaning if a company shows great metrics, there must be something getting done right, even though it may not be obvious at first glance.

On the flip side, looking into KPIs often also reveals early red flags in a business model, such as unhealthy unit economics; that can become troubling later on as the company grows. In many cases, a company’s current KPIs will also form the basis of valuation range expectations, (though some might say early-stage valuations are more of an art than a science).

Post Investment

With increasing maturity of a company comes increasing focus on KPIs. While at the early stages it is more often about a strong team, product, and differentiation, later stage investors will increasingly look for operational metrics.

Working together with the founders post investment, KPIs are an ideal way of setting and aligning goals and tracking achievements towards these. It also makes steering strategic decisions easier as you’ll see their impact black on white. It quickly becomes all about predictability of generating revenues and a clear path to profitability at scale.

Your Northstar Metrics

Revenue, EBITDA, cash burn, gross margin, CM1/2/3, ARR, cARR, ARR per employee, new ARR, magic number, net dollar retention, CAC, LTV, payback time… the list goes on but there are few Northstar KPIs that help you to quickly get a health check of any startup/scaleup. Below is an extract from some of the KPIs included in the report. Full report below.

Expectations in 2023

If you were to put a theme on venture capitalists’ expectations in terms of KPIs for the year 2023 and beyond, it would be coined “sustainable growth”. This stands in stark contrast to the focus on “growth at all costs” that we saw in many cases in 2020 and 2021.

This sustainable growth can be summarized as a healthy balance between topline growth and cash burn. Translated into metrics, this means focus on ARR per FTE, payback period, net dollar retention rate, and other efficiency metrics. Of course, established concepts like triple triple double double double growth for SaaS businesses or rule of 42 are still valid.

Get the Full Report Here👇

If you want to learn even more about metrics, there’s no way around

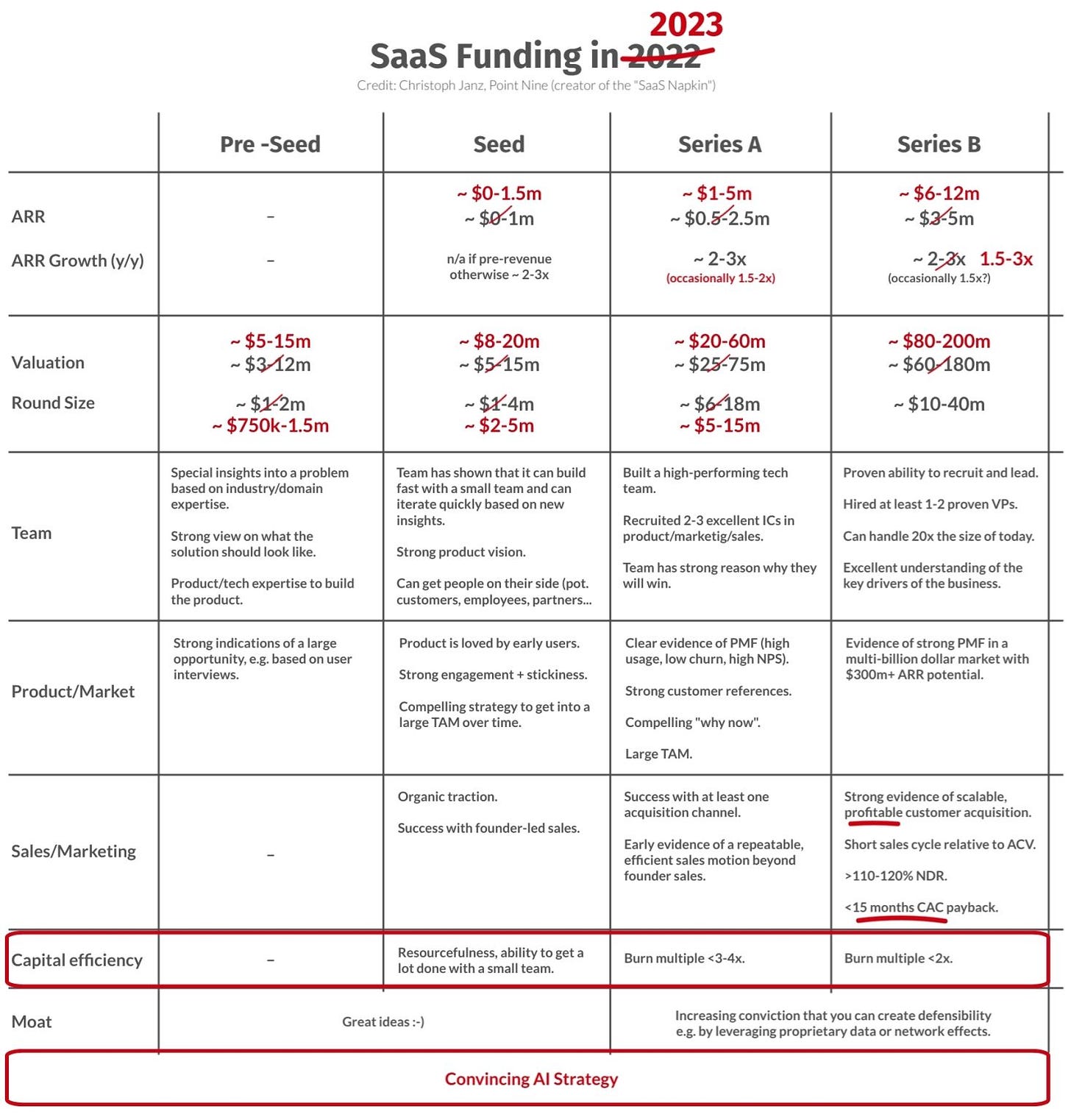

by the one and only 👀 and Christoph Janz’ SaaS Funding Napkin below.Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

Loved the article! I would add the Rule of 40, the magic number and maybe other typical metrics like the Payback period. Let me know what you think! ;)