Multi-Tasking vs. Deep Work: What Works Best for Investors

DDVC #51: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 13,005, +184 since last week

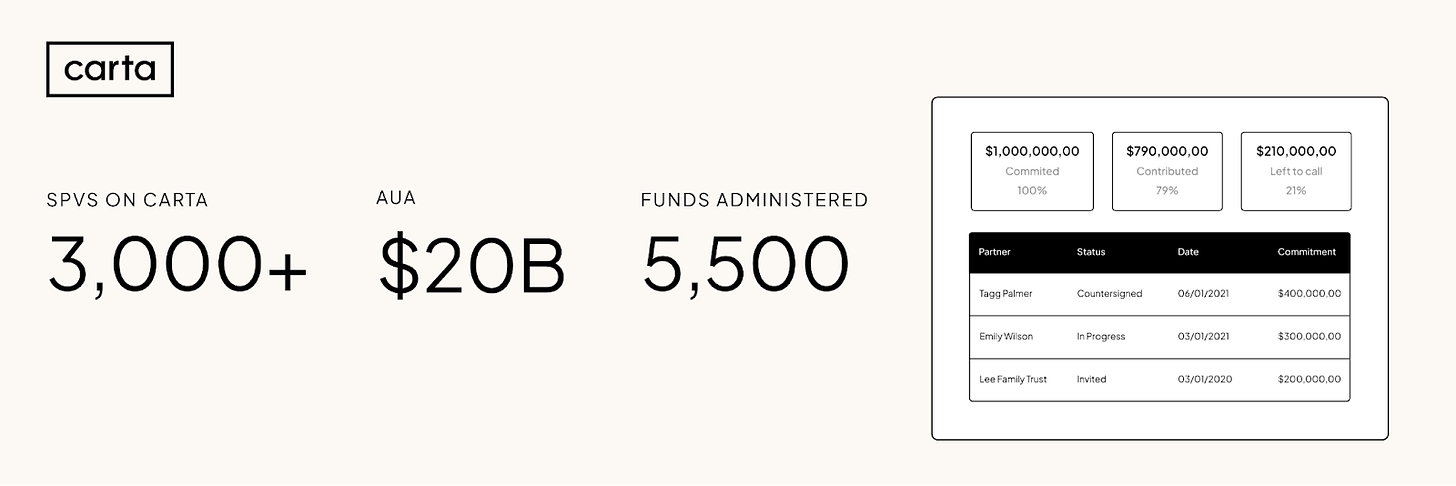

Brought to you by Carta - Your Equity Management Solution

Carta is a platform that helps people manage equity, build businesses, and invest in the companies of tomorrow. Our mission is to unlock the power of equity ownership for more people in more places. Carta manages over two trillion dollars in equity for over two million people globally. The company is trusted by more than 38,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity, venture capital solutions, and more.

Attention is All You Need

The infamous 2017 paper “Attention is all you need” was not only the epicenter of the recent AI wave but probably best summarizes a major theme of today’s modern world: Everyone competes for attention, from Instagram over TikTok to LinkedIn and Twitter. As a result of exploding information overload and increased context switching, the human attention span shrinked to 8 seconds, 1/3 less than it was a decade ago, and undercutting a goldfish.

In the ever-evolving world of investors, professionals are bombarded with numerous tasks that compete for their attention. Sourcing, market analyses, product reviews, due diligence, portfolio management, and maintaining investor or LP relationships are just a few aspects that make up an investor's daily life.

With so much to handle, the question arises: Is it better to multitask or to engage in deep work? Having spent several years coding and conducting a PhD, I know what proper deep work and tunnel vision feel like. On the flip side, my transition into venture was rough as it forced me to quickly adapt to multi-tasking to stay on top of things. In this post, I will delve into the merits and demerits of each approach and explore what works well for investors, sharing best practices from my own experience.

Multi-tasking is a VC Superpower

Multi-tasking is often seen as a survival skill in the frenetic world of venture capital. It involves handling multiple tasks concurrently—vetting a pitch deck while answering emails and taking calls from founders. Every day looks different and it is key to stay on top of things and be capable of juggling multiple tasks.

Pros:

Quick Response Times: In an industry where time-sensitive decisions are the norm, the ability to multi-task can be a significant advantage.

Diverse Engagement: Allows for simultaneous interaction with different stakeholders, be it founders, co-investors, or board members. Diversity of perspectives allows you to comprehensively access an opportunity.

Cons:

Quality Compromise: The risk of making hurried judgments or missing critical data points can be high when attention is divided.

Increased Stress: Juggling multiple tasks can elevate stress levels, making it harder to make clear-headed decisions.

Something I strongly dislike is that a lot of investors (unfortunately also non-investors..) check their phones all day long, disrespecting their conversational partner and leaving the impression that something more important might just happen. This is the limit of multi-tasking. If you commit to a meeting, please be present and dedicate all your attention to your counterpart.

Techniques to Get Multi-Tasking Right

Checklists: This is my clear number 1. Keep a checklist to ensure you're not missing out on any of the tasks you're juggling. For easy accessibility, I use Apple notes (works on iPhone and Macbook and is always synched) together with a more structured collection in Notion. Don’t overthink what you put in there, as long as your mental note finds its way to the list.

Task Batching: Group similar tasks and complete them in a specific block of time to reduce the mental load of switching between different types of activities, thus making the most of your cognitive resources. For example, instead of responding to emails intermittently throughout the day, you might batch this activity into a single one-hour block in the morning.

Notes: I shared my Second Brain technique here. Dumping my brain throughout or right after a meeting is key to freeing up capacity for the next task without being afraid that something gets lost. I finish every note with a summary and the next steps that get linked into the above checklist.

Delving Into Deep Work

Deep work is the act of intensely focusing on a single task without distractions for a prolonged period. For a venture capital investor, this could mean uninterrupted time spent crafting and vetting a new investment thesis, conducting due diligence, or strategy planning for portfolio companies. For more complex topics, it’s key to be able to dive deep and draw the right conclusions by applying analytical rigor.

Pros:

Thorough Analysis: Deep work fosters a better understanding of potential investment opportunities that in turn drive superior returns.

Enhanced Decision-making: Venture is oftentimes not as straightforward and it’s a lot about reading between the lines, balancing gut feeling and strong analytical rigor. Getting the balance right requires time to think and reason.

Cons:

Missed Opportunities: The time spent in deep focus might make you unavailable for other, potentially more lucrative opportunities to learn or invest. Focus time spent on the wrong priorities leaves significant opportunity on the table.

Challenging to Schedule: Given the unpredictable nature of venture capital, finding large chunks of uninterrupted time can be difficult. There’ll always be this one meeting that needs to be squeezed in.

Techniques for Deep Work

Time Blocking: Allocate specific blocks of time for deep work where you can focus solely on one task. During these periods, eliminate or minimize all distractions. For example, I block Wednesday nights to write this newsletter and every morning before 10 a.m. to read through the articles and papers in my backlog.

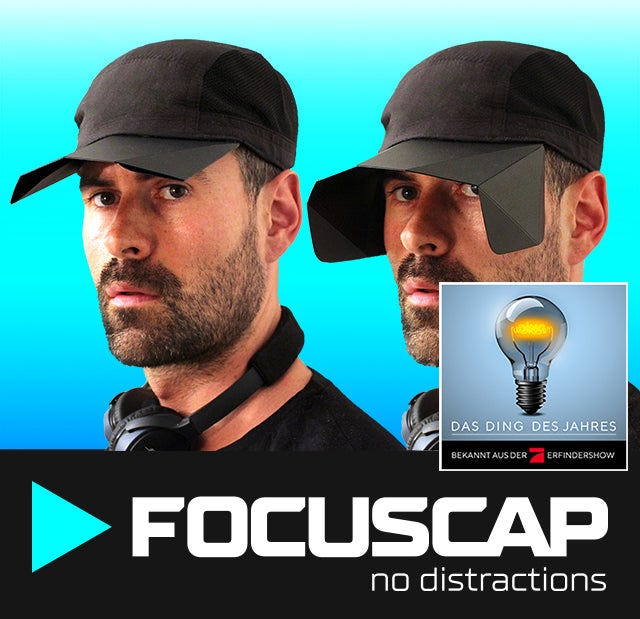

Workplace Setup: Create an environment conducive for deep work. This might include a tidy workspace, noise-canceling headphones, or specific lighting. Throughout COVID, I worked a lot from my bedroom or kitchen table, mixing personal and professional worlds altogether. As a consequence of decreased energy levels, I set up a dedicated workroom as the only place where work gets done at home. I highly recommend “Optimizing Workspace for Productivity, Focus, & Creativity” by Andrew Huberman, in case you’d like to get some more science-based productivity hacks.

Pomodoro Technique: Work for a set time (e.g., 25 minutes) and then take a 5-minute break. This can help maintain high levels of focus without burning out. As VCs, we tend to be stuck in back-to-back meeting marathons without being able to breathe. This negatively impacts our attention span and ability to make thoughtful decisions. Therefore, it’s key to include breaks in your hectic schedule.

A Balanced Approach: The Best of Both Worlds

For venture capital investors, a hybrid approach that combines multi-tasking with periods of deep work can often yield the best results. Below are some of the techniques that helped me get the balance right.

Dynamic Scheduling: Some days or parts of the day can be reserved for deep work, and others for multitasking. Test different setups to find the most productive one, e.g. no calls and deep work in the morning and meetings in the afternoon or just a “no meetings Wednesday”. Play around, find your optimal setup, and communicate it to your team.

Transitioning Activities: Have certain activities that help you transition from deep work to multitasking and vice versa. For instance, a quick walk, deep breathing exercises, or a brief chat can help.

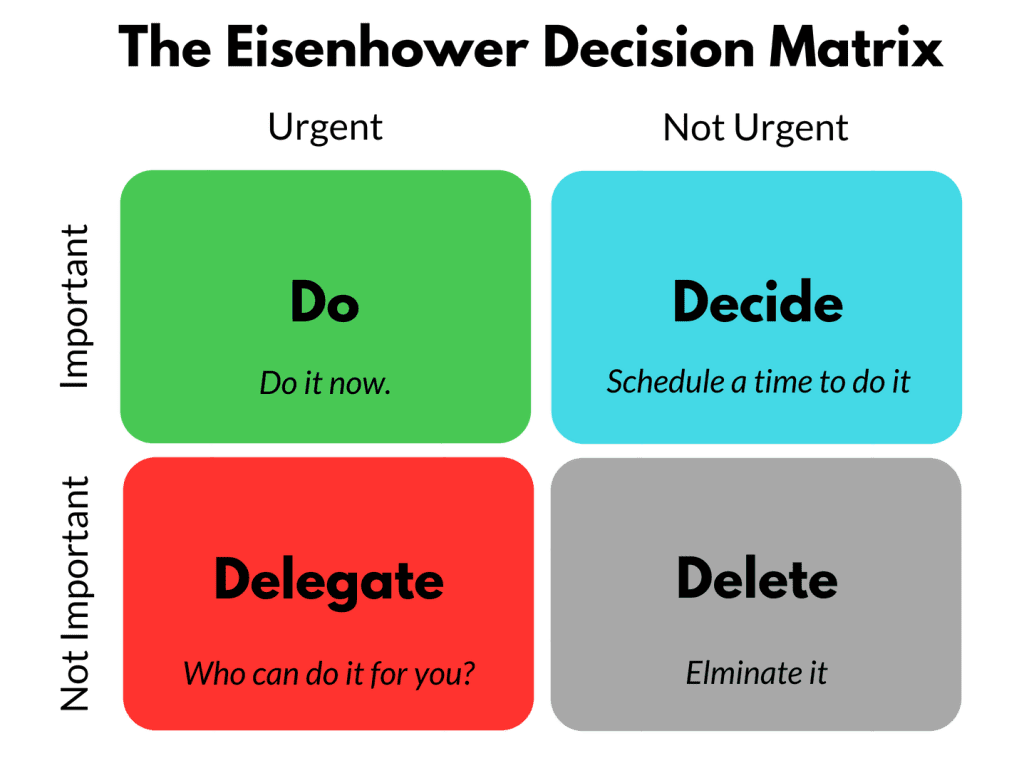

Prioritization: Use techniques like the Eisenhower Matrix (probably the most famous framework, see below) to prioritize tasks that require deep work vs. can be delegated or handled via multitasking. Internalize this framework to a degree that you don’t even need to think about whether a task is worth switching modes.

Balancing deep work and multitasking is challenging but achievable with a considered approach. The key is to be mindful of your energy, focus, and the demands of your tasks, and to adapt your working style accordingly.

Conclusion

In the fast-paced world of venture capital, the ability to successfully multitask and engage in deep work is not just an asset—it's a necessity. Multitasking allows VCs to manage a broad array of responsibilities, from due diligence and portfolio management to networking and strategic planning. Techniques like time blocking, task batching, and efficient note-taking can help investors manage these disparate tasks effectively, ensuring that nothing falls through the cracks.

Conversely, deep work is essential for tasks requiring intense focus and analytical thinking, such as evaluating potential investments or developing long-term strategies. In these cases, VCs need to create an environment conducive to deep concentration, perhaps by setting aside specific "no-distraction" time blocks, being mindful of a productive work setup, or taking regular breaks.

The key to combining multitasking and deep work lies in strategic time management and self-awareness. Knowing when to switch between these two modes of work can be guided by both the urgency and the importance of the tasks at hand. Dynamic scheduling and transitioning activities can aid in this process.

In sum, the most successful VCs will skillfully integrate multitasking and deep work into their routines, optimizing their productivity and decision-making abilities in a competitive and ever-changing landscape. Getting the balance right is one of the most difficult tasks in VC and I know few who got there. For me, I’m still on it..

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎