"Leveraging Data Moves from Nice-to-Have to a Must" with Francesco Corea (Greycroft)

DDVC #54: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 13,556, +225 since last week

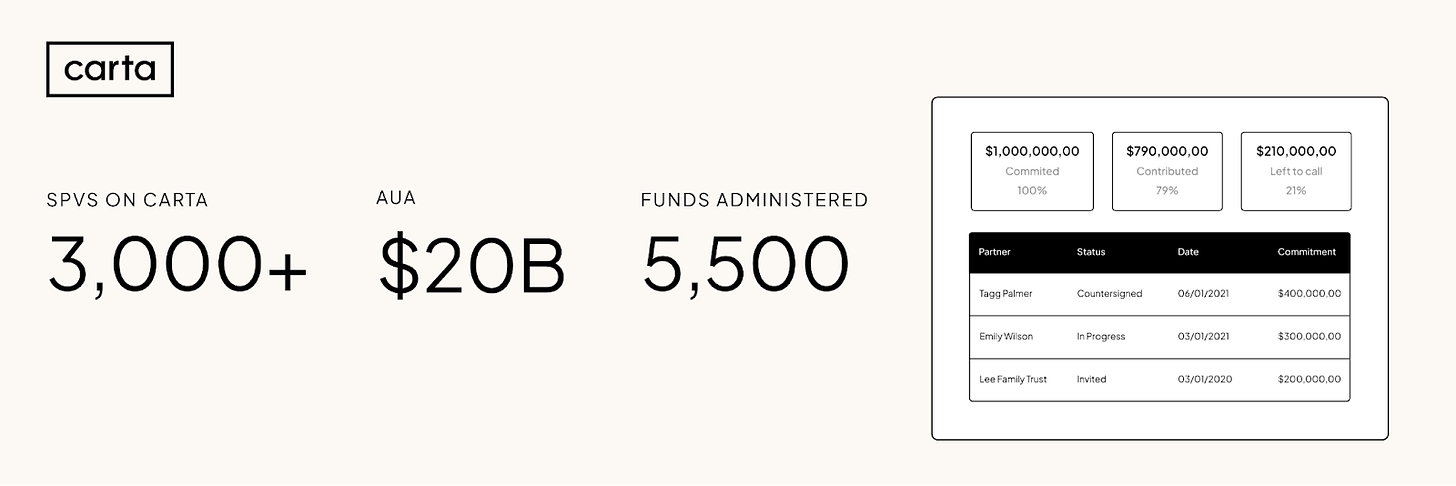

Brought to you by Carta - Your Equity Management Solution

Carta is a platform that helps people manage equity, build businesses, and invest in the companies of tomorrow. Our mission is to unlock the power of equity ownership for more people in more places. Carta manages over two trillion dollars in equity for over two million people globally. The company is trusted by more than 38,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity, venture capital solutions, and more.

Data-driven VC Interview Series - Part #3

Following the successful launch of the “Data-driven VC Landscape 2023” and the positive feedback on the first two episodes of this Q&A series with Pietro Casella from EQT and Mike Arpaia from Moonfire, I’m excited to continue with another high-profile thought leader: Francesco Corea.

Francesco has been researching the impact of data-driven approaches and AI on VC for several years. After completing his PhD and Post-Doc research, he joined Balderton in London to launch their internal data initiatives. Three years later, Francesco crossed the pond to become Director of Data Science at Greycroft.

Thank you for sharing your valuable perspectives below, Francesco!

#1 What’s the status of the VC industry in terms of data-driven initiatives and AI?

FC: We are in the Renaissance phase for data-driven investing. The cost of experimentation decreased drastically, there are more and more data providers and sources you can leverage, and the market is making data & AI a necessity. That said, we are far from being an entirely data-driven industry.

#2 Why should VCs become more data-driven?

FC: I think we are approaching the tipping point where the majority need some degree of data-driven culture to become and remain competitive. So to some extent, it is moving from a nice-to-have to a must.

And you need to be data-driven because everything is larger, faster, and earlier; there are so many funds around and differentiation is hard to show sometimes. Finally, because quality is increasing overall, you can’t simply trust your gut anymore to win the best deals and allocate your capital wisely.

#3 What’s your perspective on buy versus build? Is it “either-or”? Combination?

FC: In my view, the approach of buy versus build is not "either-or”, but a strategic combination. It's important to recognize that funds primarily serve as investors, rather than engineers. Therefore, it makes sense to consider building when there is a need for a unique solution that doesn't currently exist or when there is a proprietary advantage/value add.

However, it's worth noting that the majority of tools and data are readily available to buy. In many cases, it’s difficult to see the ROI on developing and building something entirely from scratch. Established companies focused solely on the development of such solutions often have the expertise and resources to provide a more robust and reliable product or service that can scale.

#4 What are your major challenges or bottlenecks when looking at data-driven initiatives?

FC: The cost of talent and data is still a major hurdle. The infrastructure per se is widely available, but data purchase, scraping, and storage are a real differentiation. It is the same for people working on this, who are expensive, hard to find, and may work in the blind with virtually no feedback loop for months or years.

But counterintuitively, everything is secondary to the biggest problem funds encounter the first time they leverage data & AI: culture. If you don't have a data-driven culture, whatever you build takes second place.

#5 What would you recommend to a VC firm that just started out to become more data-driven?

FC: Hire someone senior enough and set him/her up for success; don't rush into results; start slowly, with high-value, low-effort wins; dedicate a part of the budget to buying data and experimenting; create an incentive mechanism for the investment team to work with your data/research function. And finally, don't try to reinvent the wheel but focus on things that really make a difference.

This is it for today. Hopefully, you enjoyed this short interview-style episode with DDVC thought leader Francesco Corea.

Stay driven,

Andre

PS: Do not miss the chance to complete this super-easy, 2-minute reader survey to win a $100 Amazon gift card and ensure that Data-driven VC is built with you, the reader, at its heart.

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

Hiring Head of Data and setting that leader up for success is key. If you want a working solution built, it will get built that way. If you want a slide deck on what options you could take, assemble a small team to spend two hours a week on "data strategy research" away from their main job. Or hire a consultant. I see a many orgs do #2 and end up with slides, when what they really need is a solution.