It's Not What You Know, But Who You Know

DDVC #59: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 14,500, +215 since last week

Brought to you by VESTBERRY - The Portfolio Intelligence Platform for Data-driven VCs

Watch a short video showcasing the automation of monthly portfolio performance reviews through workflows using ChatGPT, Vestberry, Slack, and Gmail via make.com! Discover a new way to stay updated on your portfolio's performance and offer support to your portfolio companies with the power of AI.

Welcome back to another episode of the “Insights From the Data” series where I summarize useful research for founders and VCs. Today, I’m excited to share a recent study called “Alumni Networks in Venture Capital Financing”.

Major Findings

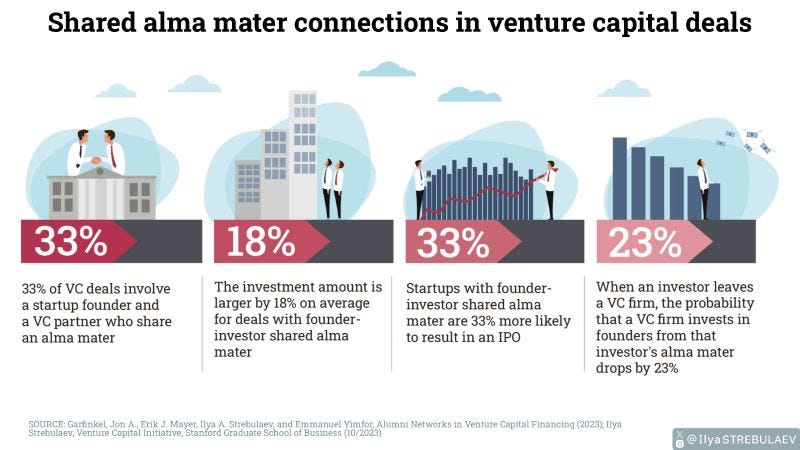

Prominent Alumni Connections: Approximately 1/3 of VC deals involve a startup founder and a VC partner who graduated from the same institution.

Alma Mater Preference: VC investors tend to favor startups from their own academic institutions. This inclination is not influenced by factors like geographical proximity or the propensity of prestigious institutions to produce both entrepreneurs and VC investors.

Effective Deal Identification: The preference of investors for alumni-founded startups indicates an advantage in information access rather than simple bias. Such connections lead to better deal identification, with investments in connected startups being 33% more likely to result in an IPO after funding, highlighting the significance of this informational edge.

Consequences of VC Partner Exits: The departure of a partner from a VC firm may disrupt the existing connections with startups from the same university. The authors have noted a decline in deals following such departures, with a 23% decrease in the likelihood of funding for startups connected to the departing partner’s university.

Investment Size Correlation: The investment size is typically 18% larger when a VC investor and a startup founder have attended the same university. This suggests that the connection is not merely about favoritism but indicates a readiness to invest more substantial amounts compared to deals without such connections.

Data & Methodology

The authors reference my database benchmarking study from 2020 and thus use a comprehensive sample of deals between 2000 and 2020 listed in Pitchbook. They complement it with the Department of Education’s College Scorecard data which includes information on the characteristics of U.S. institutions of higher education such as enrollment, location, and average SAT score of students admitted. In the absence of such data, the authors supplement the sample with LinkedIn data.

Via fuzzy matching, they connect the different sources and match 490 universities, which results in 90% coverage of all deals listed in Pitchbook. Hereof, the authors analyze 18,022 startups that received funding from 1,662 VC partners.

Conclusion

The paper suggests that connections based on academic affiliations in the VC sector enhance the exchange of valuable information, as opposed to directing funds to subpar startups. It seems like the old saying “It’s not what you know, but who you know” seems to be particularly true for VC investors. But what does that mean in practice?

For Founders: There are two ways you can leverage these insights. Firstly, focus your initial investor conversations on VCs from your own alma mater as they’re more likely to convert and invest larger amounts. Secondly, check the backgrounds of the VC Partners in your funnel, research potentially common history such as a shared alma mater, and don’t be shy to refer to it. While the first approach is surely in line with this study, the second leverages a similarity bias as described in “Whatever you do, be aware of these 21 biases”

For Investors: If you’d like to get access to preferred deal flow from a specific institution, you’d rather hire an investor from their alumni pool. For example, my friend Judith is a General Partner at La Famiglia and an alumna of the famous CDTM (an elite program between TU Munich and LMU). Her firm invested in companies founded by other CDTM alumni such as Personio (10bn), Forto (2.1bn), Y42, Orbem, Luminovo, Languse, Stitch, Zavvy, and others. Call this preferred access ;)

Stay driven,

Andre

PS: Leave a like & share this episode with your friends if you enjoyed it. Helps me to see what resonates and write more such pieces :)

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎