Data-driven VC #28: What VCs can learn from hedge funds

Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 7,010+, +310 since last week

Brought to you by Affinity - Find, manage, and close more deals with Affinity

Affinity Campfire brings together industry-leading dealmakers to explore what it means to be a part of the leading relationship intelligence ecosystem. Dive deeper into the importance of data-driven sourcing and what dealmaking will look like in 2023 as we navigate a changing global landscape.

As a few days ago this newsletter turned 6 months, I sat down to reflect on your valuable feedback and diverse perspectives. One of the most frequently asked questions is about my perspective on the future of VC and “where this whole data-driven stuff will eventually lead to”. Therefore, I dedicate today’s post to sharing a brief update of my “The Future of VC: Augmenting Humans with AI” post from Dec 2020.

The hedge fund industry’s inflection point

Up until the 1980s, hedge funds were largely run by Wall Street veterans who relied on their instincts and connections to make investment decisions. However, as more data became available, a new breed of hedge funds emerged that used quantitative models to make data-driven investment decisions and eliminate human cognitive bias in the chase for returns.

When Stephen Cohen, founder of S.A.C. Capital, one of the top hedge funds of the last century, started aggressively hiring quantitative specialists while at the same time cutting his stock-picking team of fund managers by nearly two-thirds, it became clear that “quant” was here to stay.

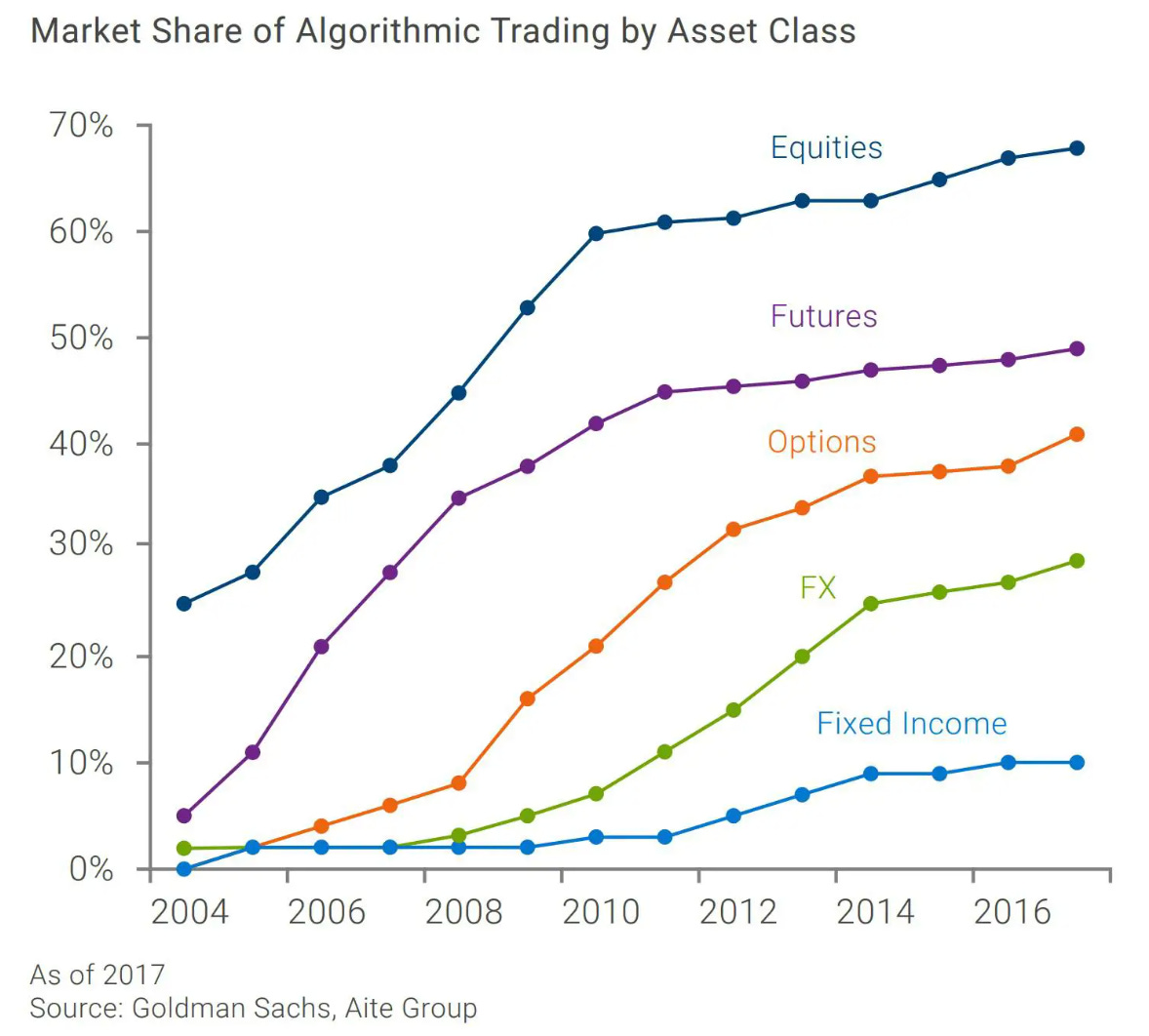

With pioneers like Cohen leading the algorithmic trading revolution of the hedge fund industry, we saw a range of manifestations on the spectrum of pure quantitative strategies, where mathematical algorithms make all of the asset allocation or stock-picking decisions, to “quantamental” strategies, which combine the traditional stock-picking skills of fund managers with data and computing power.

Today, quant hedge funds (in whatever manifestation) are the most successful and profitable firms in the industry and manual trading went extinct. According to recent figures, quant strategies account for 75%+ of total trading and more than $ 1 trillion in assets under management in the public markets.

What does that mean for VC?

Similarly, I’m convinced that the venture capital industry is now at an inflection point, just like the hedge fund industry was in the 1980s. Remembering that first VCs started to employ data-driven investment approaches about a decade ago, you might wonder why most of them came to nothing and why now might be a better time, right?

Well, before the rise of big data and large-scale web scraping in the early 2010s, private company data was difficult to collect at scale. Just ten years ago, public registers were not digitized, startup databases such as Crunchbase, Pitchbook and others in their early days and professional networks like LinkedIn had less than a 10th of today’s active users. As a result, comprehensive sourcing coverage was impossible to achieve and even the most data-driven investors needed to rely on their manual networks. Given the lack of proper tools and sufficient compute, it was also difficult to process these vast amounts of unstructured data and make sense of non-quantitative information.

Thankfully, a lot has changed within the past years. By now, the footprints of a new company are way easier to identify online than offline. Be it via “Stealth” searches on LinkedIn, an entry in a public register, a project launch on ProductHunt or Github, or just an ambitious developer launching an app in the app store. Equally important, we now have tools like large language models, NLP and tons of compute to process and make sense of unstructured data. Comparing our requirements today with the ones of the hedge fund industry in the 1980s, I’d say: It won’t get any better. Dinner is served.

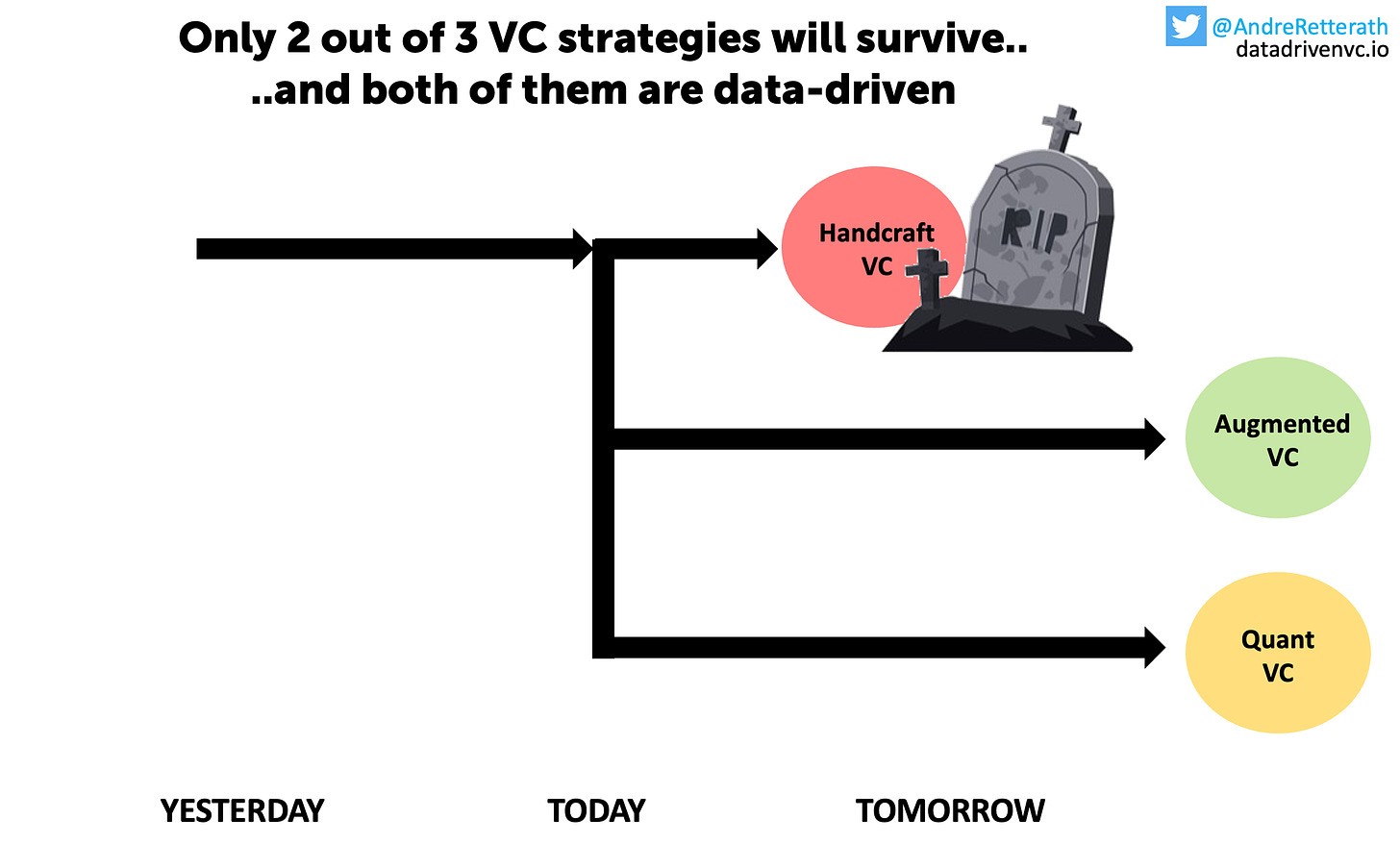

From here onwards, there’ll be 3 types of VCs and only 2 of them will survive longterm

By sharing my views on the data-driven future of VC, I was fortunate enough to have meaningful conversations on this subject with numerous investors. Listening to their perspectives, I started to classify them into three major groups.

The “Handcraft VCs” - A shrinking group of senior, gray-hair industry veterans, characterized by a strong belief that VC is more art than science and that the best deals will always be sourced through their proprietary personal networks. Moreover, they are rarely aware of their biases (recency, similarity, confirmation, over-simplification, etc.) when making decisions and tend to overestimate their position based on their firm and personal brands as well as their (oftentimes impressive) investment track records.

In times of uncertainty and technological disruption, however, where LLMs and data-driven approaches change the workflows of knowledge workers all across, past achievements become less relevant as cards are reshuffled. I personally expect this group of Handcraft VCs to face a similar destiny like the Wall Street veterans who refused to adopt quant strategies in the hedge fund industry in the 1980s. Sooner or later, they’ll go extinct.“I find that the XGBoost algorithm outperforms the median VC by 25% and the average VC by 29%.” - taken from my PhD thesis “Machine Learning and the Value of Data in Venture Capital” here

The “Augmented VCs” - Combining the best of both worlds, where machines collect, process and contextualize vast amounts of data to achieve comprehensive coverage and give direction, and where human investors focus on a select number of founders to build deep relationships and assess the soft factors based on their intuition. While data provides coverage and guidance, the human makes the final decision.

This strategy is particularly relevant for VCs with an active lead or co-lead strategy as they need to build a relationship with the founders to win a competitive deal and earn the right to join their boards.“We have access to the world’s largest data sets you can imagine, our cloud computer infrastructure is the biggest ever. It would be foolish to just go out and make gut investments,” said Bill Maris, managing partner of Google Ventures. - NYT June 23, 2013 here

The “Quant VCs” - A new species of purebred algorithmic VCs who believe that startup investment decisions should not involve humans at all, just like in pure-play quant public funds. Just algos, no humans. Fast, clean and repeatable. These investors believe that human involvement skews the models and reduces the likelihood to generate alpha.

Although there is little proof of success for Quant VCs yet, I can imagine this strategy to work well for a follower strategy. Yes, the greatest 1% of serial entrepreneurs on earth might not leave you in as their rounds are naturally oversubscribed (= risk of adverse selection), but for the remaining 9% or so of the top decile, it’s appealing to raise some quick money without questions asked. Either to solve the cold start or to fill up a proper round.Considering the law of large numbers and sufficient portfolio size (read here how Kima Ventures does 100+ investments per year and achieves top performance), I assume that based on my PhD findings, Quant Follower strategies will likely generate alpha and outperform the market as long as there are enough “Handcraft VCs”. Due to the above-mentioned adverse selection, however, I don’t believe that this strategy works for a lead, co-lead or any other strategy that aims for a significant shareholding. Founders want to know their major investors. They want value-add and someone to call if shit hits the fan.

“We would never make an investment in a founder we thought was a jerk, even if all the data said this is an investment you should make,” Mr. Maris said. “We would make an investment in a founder we really believed in, even if all the data said we’re making a mistake.” - NYT June 23, 2013 here

Conclusion

Just like the hedge fund industry in the 1980s, VC has reached an inflection point where, finally, data on private companies and the tools to process this unstructured, oftentimes qualitative information are available at scale. Similar to the Wall Street Veterans, “Handcraft VCs” will sooner or later go extinct. The two winning strategies will both be data-driven. While a pure-play “Quant VC” strategy seems suitable for a large-scale follower approach with limited target shareholding, it requires a human in the loop in an “Augmented VC” approach to build a relationship with the founders and win the most competitive deals in a lead or co-lead strategy.

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

You forgot to add the sheep VC. The VC who mostly invests in companies where top VC brands are invested.