Data-driven VC #26: The impact of gender inequality in startups

🔍 Insights from the data - Technical University of Munich

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 6,560+, +200 since last week

Brought to you by Affinity - Find, manage, and close more deals with Affinity

Affinity Campfire brings together industry-leading dealmakers to explore what it means to be a part of the leading relationship intelligence ecosystem. Dive deeper into the importance of data-driven sourcing and what dealmaking will look like in 2023 as we navigate a changing global landscape.

Following my “Patterns of successful startups” post last year, 67% of you asked for dedicated episodes diving into the most interesting “Insights from the data” about startups, their founding teams and their investors. So here we go. Every piece will have a very specific focus, short and with clear takeaways. To kick off this series, we're diving into the diversity gap and its implications for the startup ecosystem. One of the most pressing problems in our industry.

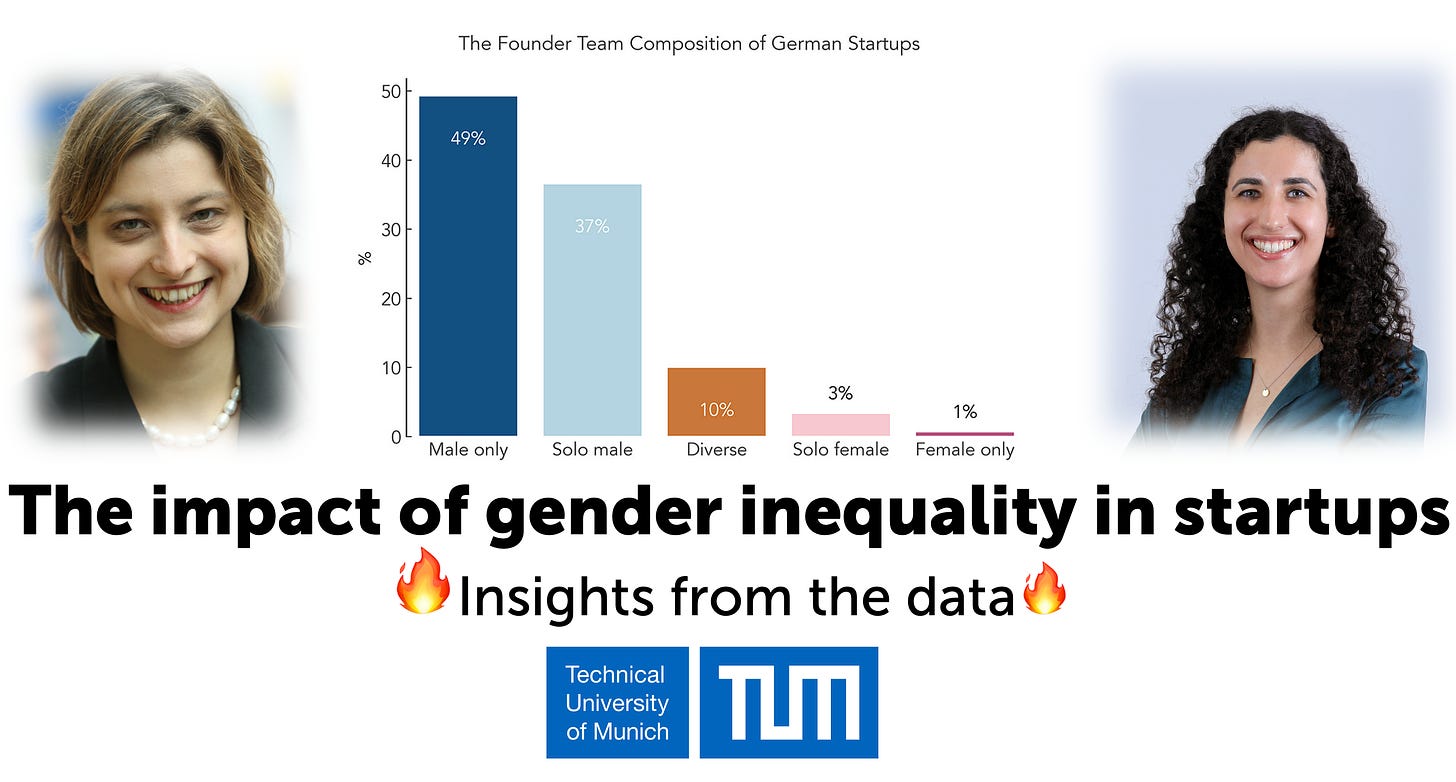

I’m happy to have Professor Isabell Welpe and her PhD candidate Nadja Born from the Chair of Strategy and Organization at the Technical University of Munich (go TUM🚀) contribute this valuable guest post. Similar to Professor Dries Faems from WHU, who thankfully contributed last week’s guest episode “A blueprint to map entrepreneurial organizations”, Isabell and her team leverage data-driven approaches to analyze the future of work and organizational design within startups, among others.

Thank you, Isabell and Nadja, for sharing your important learnings about the impact of gender inequality in startups in your guest post below 🙏🏻

What the data reveals?

Despite the fact that women make up more than half of the world's population, they continue to be significantly underrepresented in entrepreneurship, where starting a new venture has long been dominated by men. Our analyses show that 86% of German startups are founded by all-male teams or solo male founders, while solo female founders or all-female founding teams remain the exception.

Why is this problematic?

Gender diversity and equality in entrepreneurship is not just an issue of representation - it is also an economic factor. Excluding half of the population from a sector that is responsible for substantial wealth and job creation as well as economy-wide innovation is disadvantageous to all stakeholders as well as national economies.

In addition to that, scientific evidence suggests that increasing gender diversity in entrepreneurship and venture capital also pays off financially (Gompers & Kovvali, 2018). Homogeneity in entrepreneurship and venture capital, including in investments made and among portfolio companies, harms financial performance. Conversely, increasing gender diversity improves financial and innovation performance for startups and VC firms (Calder-Wang & Gompers, 2021; Dai et al., 2019).

What are possible explanations?

Gender stereotypes and a perceived "lack of fit" between the stereotypical image of women and entrepreneurs is one explanation for why women remain underrepresented in entrepreneurship (Kanze et al., 2020). It's not just about the low number of women in the field, but also how entrepreneurship is conceptualized as an intrinsically masculine endeavor (Ahl, 2006).

Studies demonstrate that both men and women perceive entrepreneurs as having characteristics similar to those of males, but only women also see entrepreneurs and females as having similar characteristics (Gupta et al., 2009). Research further shows that people who perceive themselves as more masculine have greater intentions to start their own business than those who perceive themselves as more feminine (Gupta et al., 2009).

Furthermore, the culture within the industry is heavily male-gendered, which may undervalue practices typically associated with women, such as cooperation and mutual support (Chilazi, 2019). This creates a difficult situation for female entrepreneurs who must navigate their professional identity while balancing their conflicting gender identity and societal expectations.

What can we do about it?

To counteract gender stereotypes in entrepreneurship, promoting and setting female role models and counteracting stereotypical activities from an early age on can be effective. Studies show that female role models inspire and motivate women and increase their self-perceived and other-perceived fit into specific roles. Thus, increasing the number of women in entrepreneurship and venture capital is crucial not only to create a better environment for women but also to change stereotypes and attitudes in the industry in the long term.

For instance, including female investors can already impact the social, cultural, and decision-making dynamics (Gompers & Kovvali, 2018), and featuring female entrepreneurs and investors in every industry event can shift perceptions of their representation (Chilazi, 2019). Beyond that, mentorship and organizations such as startup accelerators and incubators can be beneficial to entrepreneurs trying to navigate an uneven professional landscape, as it can improve networks through access to organizational leaders and enhance legitimacy.

Dataset and data collection

Analyses are based on data from Dealroom and LinkedIn. Using Dealroom data, we identified 708 German startups that received at least seed funding, and were founded between 2012 and 2016 by 1,063 founders.

We chose the funding range between 2012 and 2016 to ensure homogeneity in terms of the economic conditions and to minimize missing data points owing to the recency of start- ups. We analyzed data from these samples regarding founding team demographics and startup valuation and matched it with data from 34,893 employees on LinkedIn.

This was the first “Insights from the data” episode. I hope you found value in this post and encourage all of us to seriously consider these takeaways going forward. Our industry needs to become more diverse and provide chances for the most ambitious people, independent of their gender, background and education. Another reason to leverage data-driven screening approaches for investing, to reduce bias and become more inclusive.

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

This is an exciting topic! As a VC investing in social startups in India with a gender focus, my view is that gender diversity plays an important role when it comes to and is strongly linked to women's empowerment. While this is also an important aspect in more developed countries where the role of women is already strengthened, I feel that the discussion should rather be about masculine and feminine character traits instead of gender. Gender seems to be the most obvious "feature" in terms of being easily observable. This might only shift the discussion to the question of "what are typical masculine and feminine character traits"... so we might end up discussing what the character trait diversity is that we want to see among founders.