Data-driven VC #22: Why data-driven approaches are like an e-bike

Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 5,850, +210 since last week

Disclaimer: This piece is strongly hypothesis-driven and I’d love to get challenged by you!

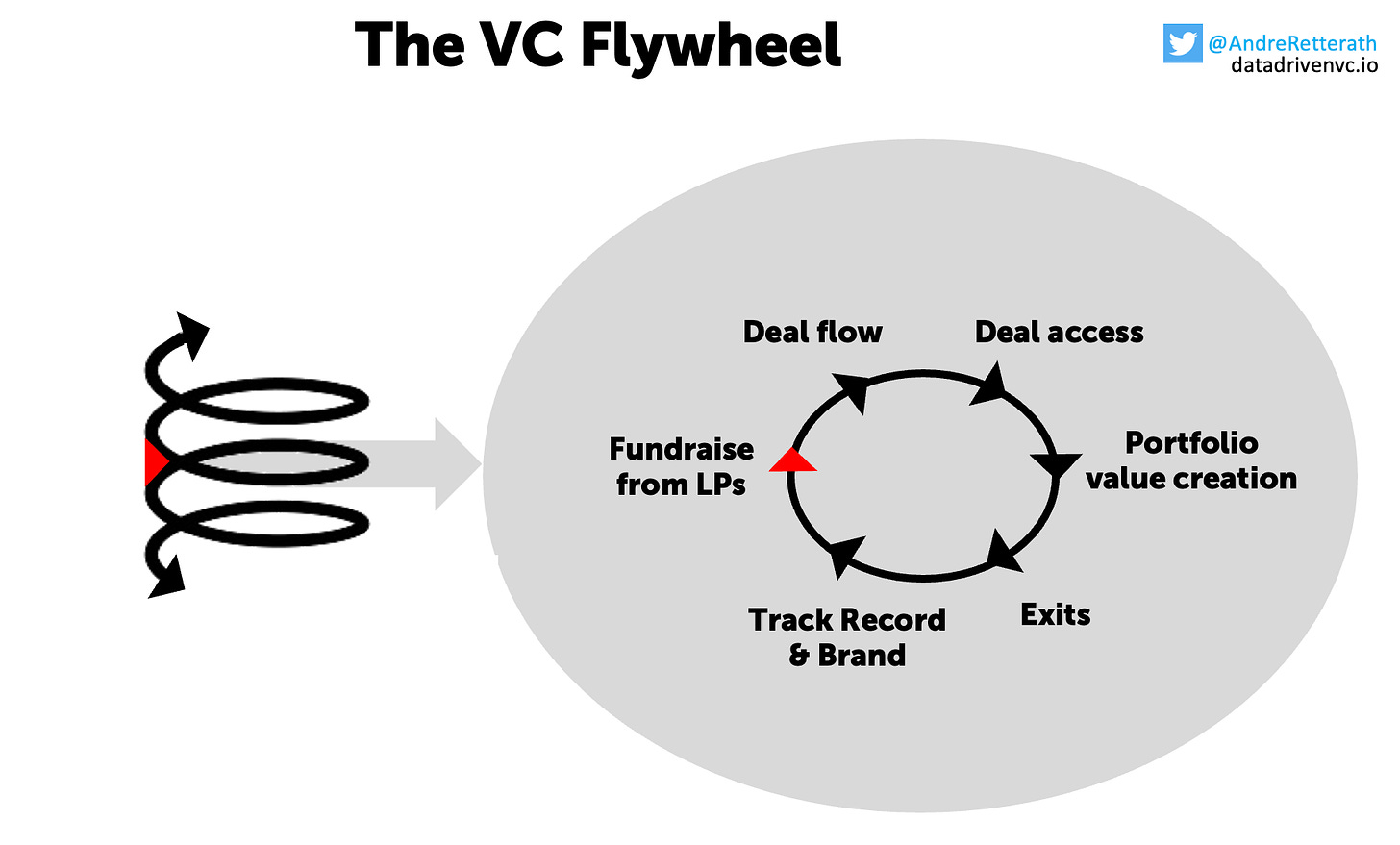

First and foremost, VC is a financial asset class with the primary goal of consistently superior returns. While some VC firms seem like they’ve always been this shiny and leading institution, it took decades of hard work for them to get the flywheel spinning. Let’s take a look at the individual steps to success and what the implications of data-driven approaches in this context may be.

The VC Flywheel, a simplified model of VC success

A new VC firm typically gets started by one or a few people with some kind of relevant experience, in most cases either entrepreneurial or investment track record. To start off, they put their own money into the fund and raise the majority of the remainder from external LPs. In parallel to their initial fundraise, they ramp up their “deal flow”, get in front of founders and try to get a first close done to finally start investing. This is where the “access” component comes into play.

Why should the best founders let you join their cap table? Typically it’s a mix of attractive terms (which are determined by a mix of your fund size, initial versus follow-on allocation, diversification strategy and target shareholding), firm brand and personal brand (which in the beginning are very much the same as mainly driven by the individual track records), expertise and personal fit. Many young firms struggle on the brand component as founders oftentimes opt for strong signaling of the VCs.

Once invested, “portfolio value creation” becomes key. Depending on the fund model (hands-on versus hands-off), this might include strategic advice, hiring support, customer introductions and support with follow-on funding rounds. Sooner or later, there will hopefully be an exit. As we all know, VC returns are distributed based on a Power-law and therefore, every VC desperately seeks one or more outliers in her portfolio. Big exits not only deliver great returns but also drive the external brand perception of the firm and the individual investor (see my previous post on personal branding here).

Unfortunately, VC feedback cycles are very long and after an initial investment phase of 3 to 4 years, the raise of the second fund is typically due before the first exits of the first fund return capital. Said differently, the wheel needs a second push before the first cycle has finished. This is common. While the second fund can oftentimes be raised based on the same ingredients as the first one, the third fund requires the VCs to present first exits and capital distributions (=DPI). This is where many rising fund managers struggle. The third fund is the most difficult one and separates the wheat from the chaff.

With the first full cycle completed, so roughly 5-10 years after the launch of the VC firm, the wheel turns into an upward or downward spiral. In the case of an accelerating upward trajectory, the spiral turns into a reinforcing flywheel where successful exits allow the VC to raise bigger funds, get more inbound deal flow and preferred access (due to their improved brand, their ability to pay higher prices as a result of larger funds etc.) to better deals which in turn are more likely to provide greater exits, which then again contribute to their track record and brand, bigger funds, better deal flow and access, better exits, better track record, better brand… You get it :)

As the flywheel continues to accelerate, it creates more and more momentum and becomes increasingly difficult to stop - except for two well-known show-stoppers:

Wrong macro decisions such as “betting” multiple fund generations on the wrong trend, e.g. Kleiner Perkins invested in 88 Cleantech startups between 2007 and 2013 leading to some of the biggest losses in VC history and a significant depreciation of their brand, see here and here

Failed generational transitions push younger Partners to spin out on their own and leave the Senior Partners with a gradually dissolving team and brand

Avoiding these pitfalls, the top VCs will continue to increase their lead and make it gradually more difficult for others to catch up. Until now 🤓

Become more data-driven to skip some cycles

Data-driven approaches allow you to get close to comprehensive deal coverage, identify the most promising opportunities as early as possible and put yourself in front of the founders before anyone else jumps on the train. This allows data-driven VCs to build deeper relationships to founders and demonstrate access-relevant value-add ahead of the competition. As a result, data-driven VCs have significantly better chances of identifying and accessing the most promising opportunities compared to their non-data-driven peers, ceteris paribus. This “unfair advantage” however, has a diminishing or asymptotic effect.

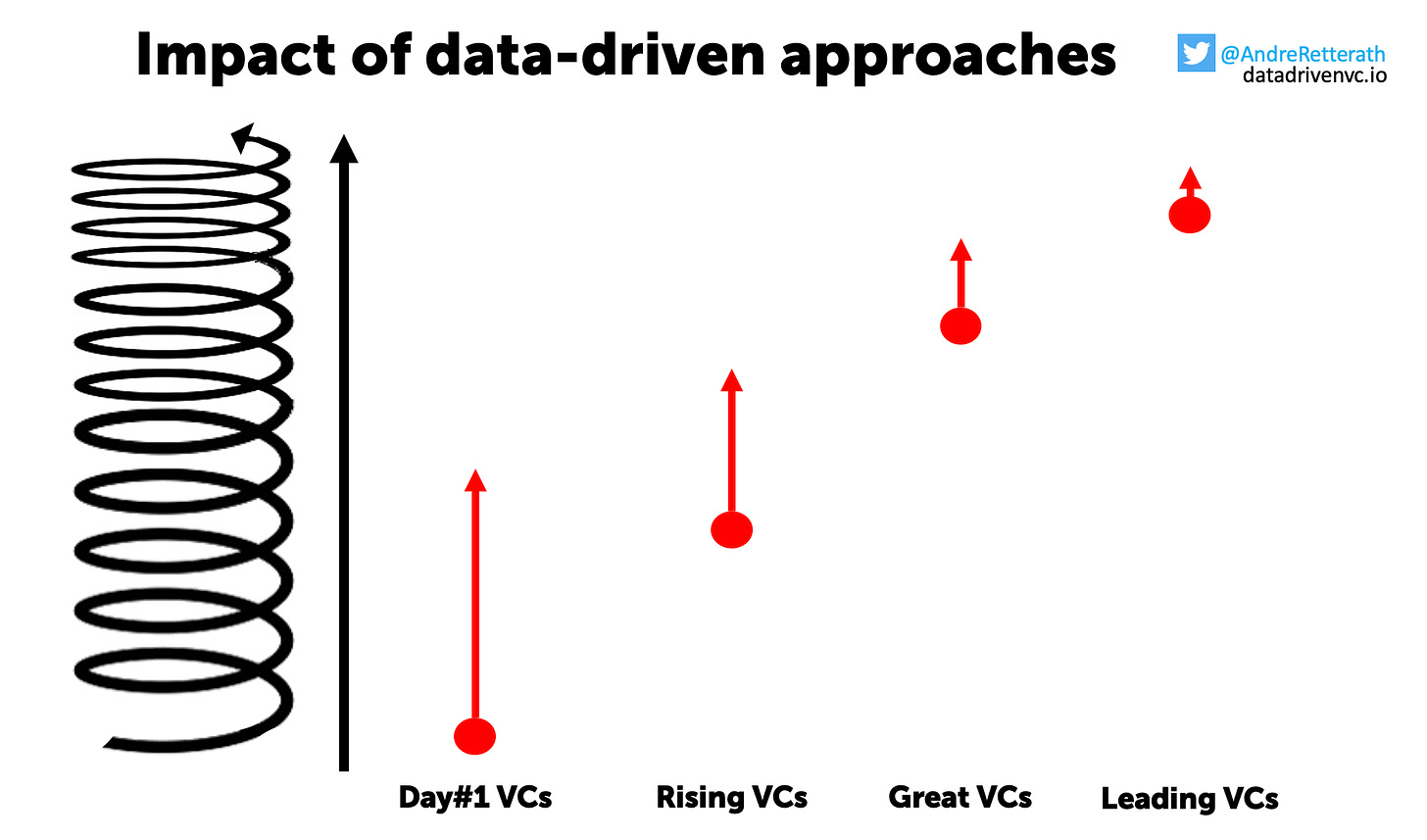

The slower (faster) the wheel spins and the younger (more mature) the VC firm is, the bigger (lower) the impact of data-driven approaches on the VC firm’s success can be.

Said differently, data-driven approaches can help new and less established “Day#1 VCs” gain an explosive headstart and allow them to play on the level of more advanced “Rising VCs” that are potentially years ahead (jump from nowhere to 50th percentile or so). For “Rising VCs”, the effect becomes slightly weaker but still allows them to compete with the “Great VCs” (jump from 50th percentile to top quartile or so). And although the impact for the “Great VCs” becomes again somewhat weaker, the application of data-driven approaches allows them to seriously compete with the leading VCs out there (jumping from top quartile to top decile or so). Lastly, for the leading VCs it can tip the scale and make the difference between being top decile and being the best.

Conclusion

Data-driven approaches are like an e-bike that suddenly allows the average Joe to compete with athletes. While it’s a game changer for the broad majority of people, it has little impact for athletes as they perform naturally on this level through many years of disciplined training. Still, it might help them get up this one steep hill faster than their athlete competitors.

In summary, I’m convinced that the application of data-driven approaches allows most VC firms to become a better, more successful version of themselves. Given the significant impact for new and just evolving VCs, even an 80/20 out-of-the-box solution (like an off-the-shelff e-bike) makes a huge difference. Don’t overcomplicate it, just start with something and avoid getting stuck in the “buy-versus-build bubble”. More on this next time 👋🏻

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎