Data-driven VC #16: The state of this newsletter

Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

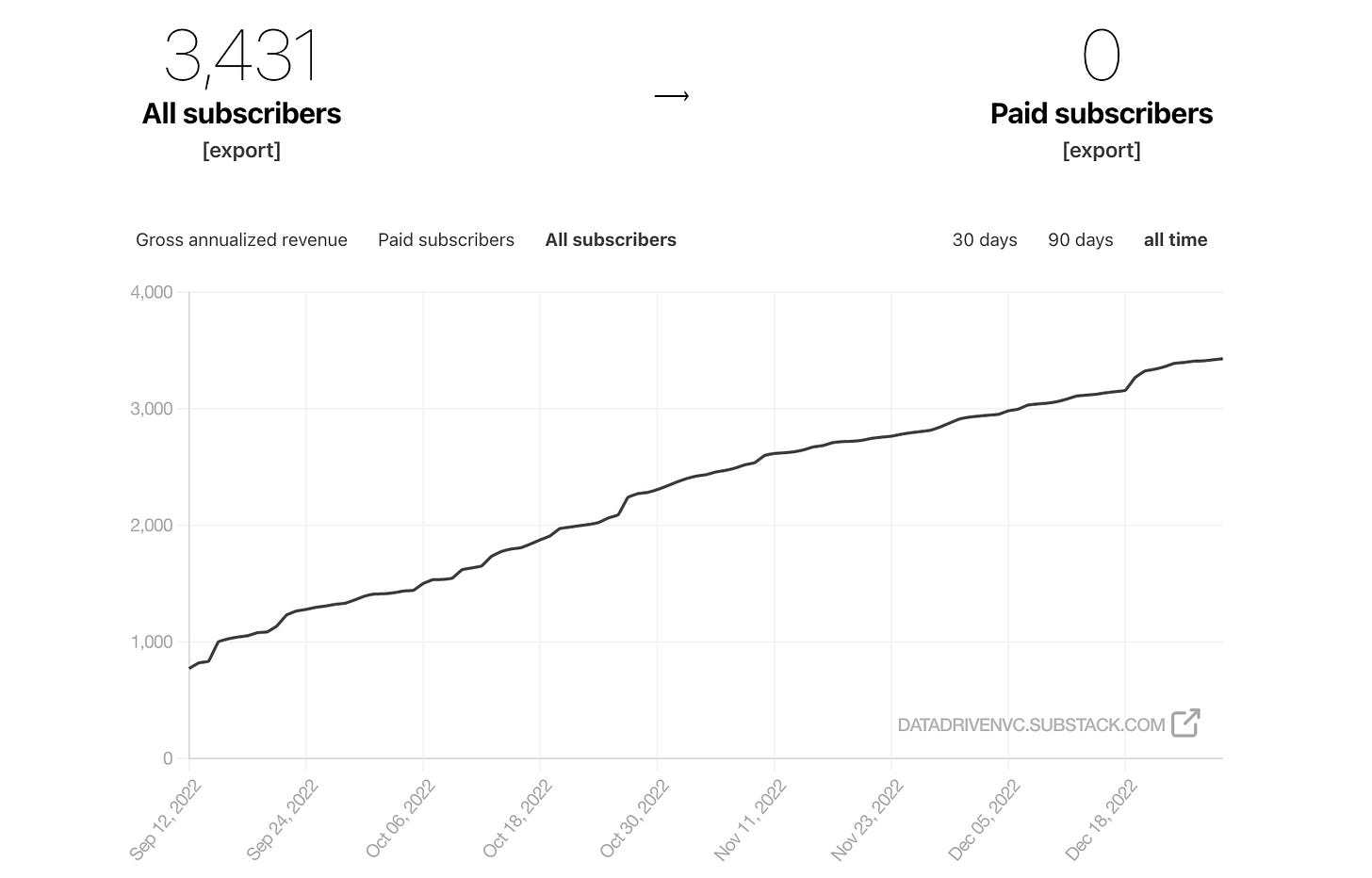

Current subscribers: 3,431, +91 since last week

The days between Christmas and New Year are perfect to reflect. To zoom out, look in the rearview, celebrate progress and critically plan ahead. Typically I prefer to do it in private by myself. But as I decided to write this newsletter and share my learnings more publicly, I take this episode as an open reflection.

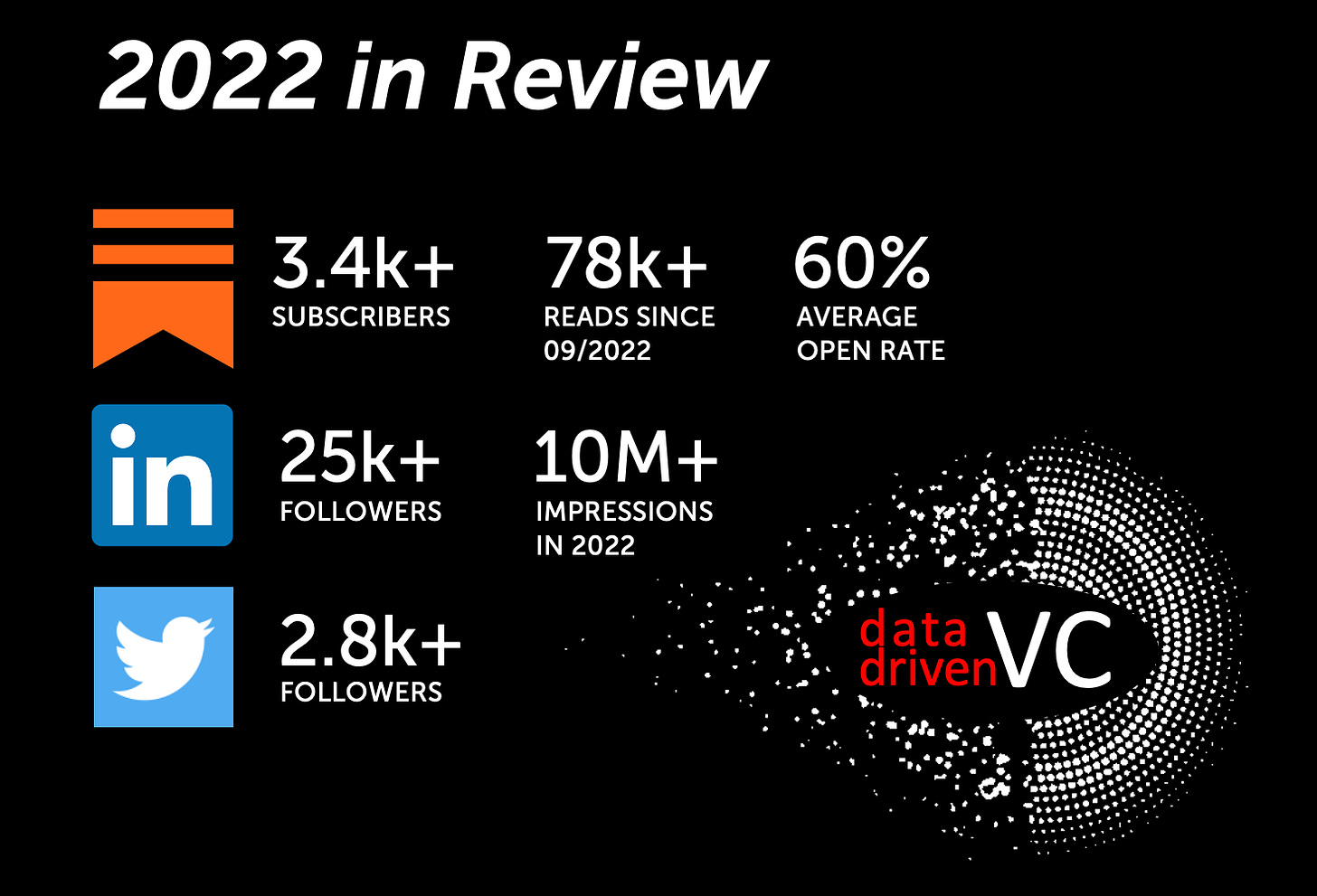

2022 in Review

Why did I start this newsletter?

As stated in my first episode on “what to expect from this newsletter” published on 11th Sept 2022 “Together with an ever-growing group of like-minded people, I made it my mission to push VC to the next level through real innovation. To overcome shortcomings from inaccessibility for underrepresented founders over biased, inefficient and manual decision-making processes to non-scalable, sometimes very limited value-add. I strongly believe that technology in general, but data more specifically, is here to disrupt VC as it did/does with any other industry.”

So the “what” is clear, but what about the “how”? Referring to episode 14 on “how VCs can learn from each other”: “Very few people are actually in the position to share hands-on learnings, what works well, what doesn’t work and where they get their information from. And those who do, are oftentimes not willing to share their perspectives because they’re afraid to lose their edge. As a result, the ecosystem is not only very early but also highly fragmented with a strong reluctance to share learnings. This is also why most researchers struggle. They lack the hands-on insights from practitioners who are in the trenches. Therefore, a close researcher-VC relationship is key to generate useful studies. This newsletter is here to change this dynamic and provide a platform for like-minded people.”

Building in public

VC is a privileged and intransparent industry where not only returns (=output) follow a Power-law distribution but also the allocation (=input). A few hundred to a thousand Partners globally decide, oftentimes behind closed doors, how hundreds of billions of $$ get allocated. It's the minority of the people moving around the majority of the money.

While some VCs share their decision-making processes and selection criteria publicly, the majority still keep their inner workings to themselves and build in the dark. As a result, opacity perpetuates. Opposing this trend, I decided not only to openly speak about and create a platform for data-driven VCs and everyone who’s interested in its implications but also to build this platform in public by sharing all the ups and downs associated with it.

Every newsletter starts with the recent number of subscribers and the growth within the prior week. Moreover, I take specific milestones to include learnings on the process of writing this newsletter and growing the community. Just like this episode.

The community

I’ve been actively writing and sharing professional content for about six years. On the content creation side, I wrote 3 academic papers with about 6k downloads and 12 Medium blog posts with about 70k reads before I joined Substack for more structured writing in September this year.

Before joining Substack, my writing process was event-driven (triggered for example by new investments, deep dives etc.) and thus pretty inconsistent. Sometimes I had several topics within a few weeks, sometimes nothing for months. No ideation process whatsoever. This inconsistency made it difficult for me to empower and facilitate valuable conversations except for very few conference panels and one or two living-dead Slack groups.

Peer learning, sparring and collaboration among VCs and researchers were very, very slow. I explain in episode #12 how I imagined this newsletter to solve this problem and become the go-to place for everyone interested in digitization in VC and its impact for all stakeholders.

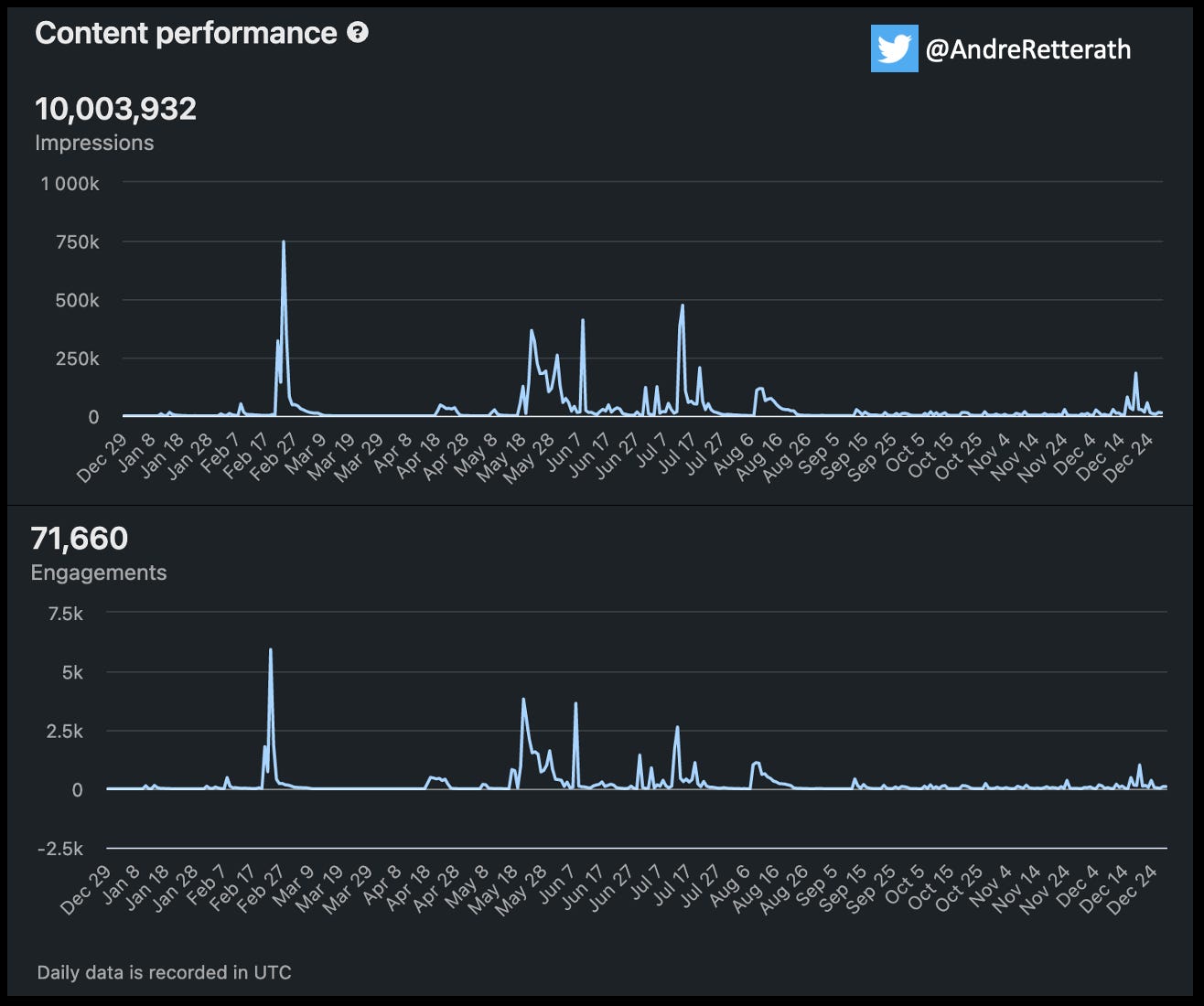

On the distribution side, I joined LinkedIn in July 2016 and have grown my audience to about 25k followers with 10M+ annual post views and 70k+ annual engagements in 2022. One interesting learning I’d like to share: Up until August 2022, I shared mostly external content for a broader audience (tech, VC, startups, productivity) and insights from my day-to-day that I found potentially useful to others. Starting in September, I strictly narrowed my focus to AI and data-driven VC, and shifted from mostly external to mostly my own content.

The LinkedIn content performance chart below reveals that this shift significantly reduced the likelihood of viral posts (until the end of August almost binary picture with few crazy spikes but also many close-to-zero periods) but increased the consistency of engagement (many tiny spikes after August with no close-to-zero periods anymore). So if you consider creating your own content, it might be helpful to leverage external content to create virality and build an audience before you start writing and distributing your own publication. Of course, many roads lead to Rome and you can also do both in parallel. Sharing only your own content from day one without an existing community might not be the best way though.

With respect to Twitter, I was, unfortunately, a bit late to the party when I joined in December 2017. Moreover, I spend most time until early 2019 or so being a passive consumer, not actively participating in conversations. As a result, my follower base stalled at a bit more than a thousand and only started to grow when I started actively engaging with other users mid of 2019. Until today, I reached 2.8k followers with a bit less than 800 tweets.

While it’s sufficient to post 3-5x per week on LinkedIn, Twitter is more demanding and great follower growth requires 3+ tweets a day and regular interaction with other users. Something I still struggle with regularly. One learning that holds true for both platforms though: Consistency is key!

In terms of this newsletter, I’m convinced that the previous groundwork and the existing community contributed significantly to the accelerated ramp-up in readers with more than a thousand joining within the first week after launch in September. Let’s look at the newsletter metrics in more detail.

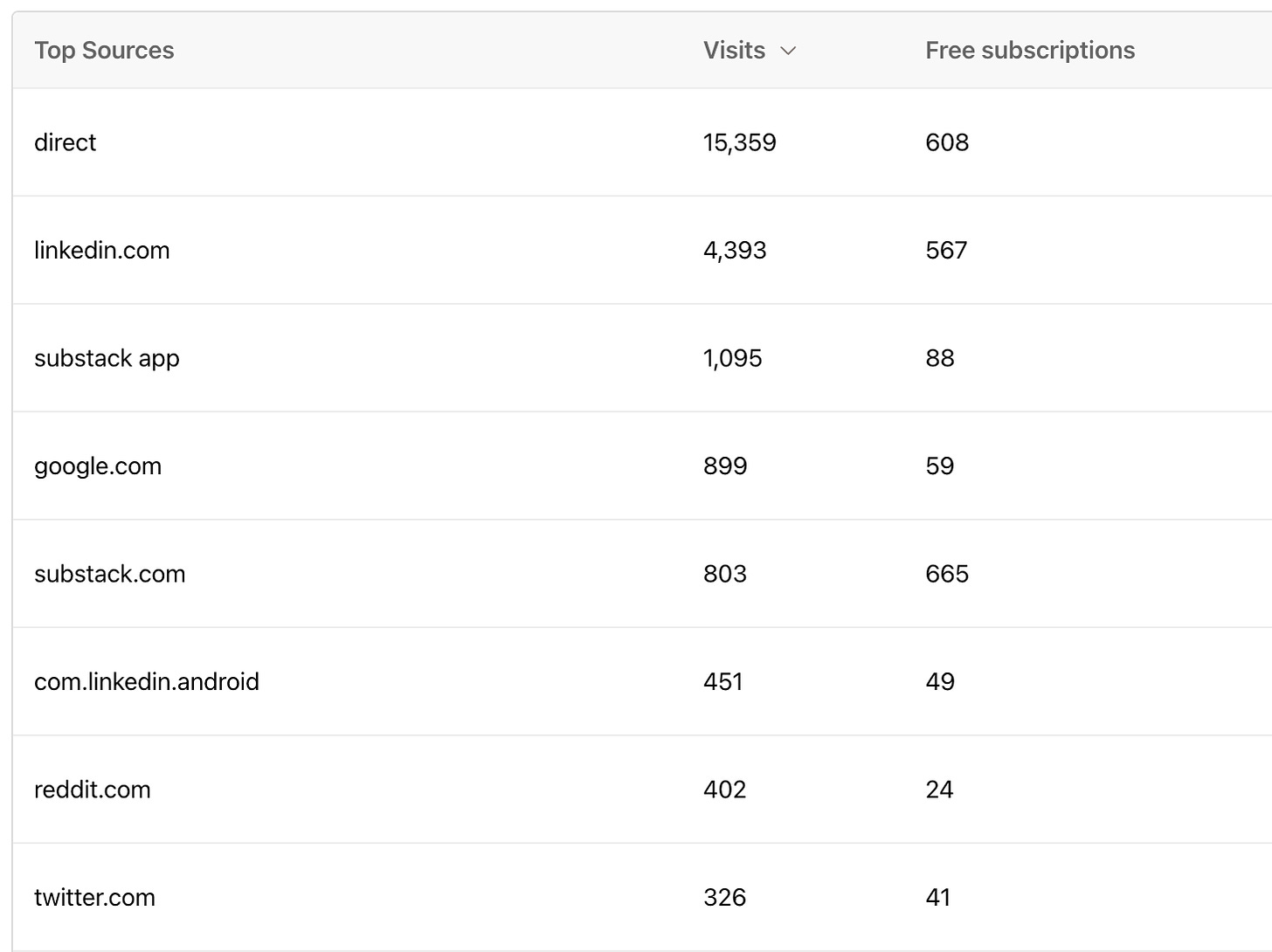

Sources of traffic and subscribers: This newsletter got read 78,148 times within the last 109 days. Most traffic came directly via search (15,359 readers), via LinkedIn (4,393 via browser or iOS app and 451 via Android app) and via Substack itself (1,095 via app and 803 via browser), see details here. Conversion rates from readers to subscribers were best for LinkedIn (12.7%) and Twitter (12.6%) confirming that my followers on the respective platforms were strongly self-selected by my previous content already.

Another great source of subscribers is Substack's recommendation feature. It allows creators to support each other. A big thank you to my top 3 recommenders and friends

from , from and from who guided more than 600 subscribers my way. If you write here on Substack and like "Data-Driven VC" too, feel free to add it to your recommendations list. I highly appreciate your support🙏🏻Subscribers: 3,431 as of today. Overall, subscriber growth has been pretty consistent with an average of about 150 new subscribers per week (excluding the first week with about 1k new subscribers of course). Clearly, there is room for improvement on the distribution side but I want to keep my social media channels as high quality and low noise as possible. So for the moment: 1 LinkedIn and 1 Twitter post per Data-driven VC episode.

Split by profession: 40% VCs, 36% Startup Founders/Operators, 15% Researchers, 9% Others (PE investors, LPs, Corporates etc.) with about 10% of all readers having a CS/technical background

Open rates (OR): 60% on average, with all episodes ranging between 54-69%. Benchmarking this with other Substack publications, I’m extremely excited to see such a strong engagement and hope to keep it up in the future 🙌🏼

Reads: 78,148 in total across 19 episodes, with 3 of them being monthly round-ups (accounting for 9,699 reads, so comparably underperforming) and 16 deep dives (accounting for the remainder)

Overall, the Data-driven VC community grows nicely and is highly engaged, proving the value of the content. A great foundation to build on👷🏼♂️

Top 5 episodes (by number of reads)

Episode #12 “Personal branding 101 (+LinkedIn & Twitter hacks)” with 5,291 reads and 57% open rate

Episode #9 “Patterns of successful startups” with 5,285 reads and 60% open rate

Episode #7 “How to automate startup screening?” with 5,280 reads and 60% open rate

Episode #1 “Why VC is broken and where to start fixing it” with 5,182 reads and 66% open rate

Episode #2 “How to not miss an investment opportunity anymore” with 4,878 reads and 61% open rate

2023 and the future ahead

The product roadmap

Based on the healthy foundation of 2022, I will add a few select new features in the course of the next few months to increase the value of Data-driven VC and accelerate our industry’s transition to become more efficient, effective and inclusive. Thanks a lot to all of you for sending me hundreds of DMs, commenting on my posts and regularly participating in my polls. It really helps me to focus and prioritize.

The two most requested additions on the horizon for early 2023:

“Data-driven VC Landscape 2023” aggregating the VC firms leading the data-driven disruption with dedicated engineering teams, showing what they work on, what their tech stack looks like, who they follow for inspiration and more. My goal is to create transparency on the state of digitization in VC, streamline information and provide resources for those investors who want to follow along.

Someone in mind who should not miss on the landscape? Submit your input for the “Data-driven VC Landscape 2023” by end of the year to receive the full landscape and report before everyone else.

“Insights from the data”: No poll was as clear as the previous one. 92% of you want short 1-2 minute episodes with one specific research finding (from myself or external researchers), an explanation and a “what does it mean” conclusion. About 3/4 of you asked for bi-weekly and 1/4 for monthly episodes in addition to the existing deep dives.

I’m lining things up to launch soon and have already singled out some interesting analyses from my previous work. More importantly, I’d love to hear which startup and/or VC insights you’d be interested in (can’t wait to crunch the data 🤓) and/or which researchers I should invite to contribute.

More additions like a Slack group, Podcast, AMA virtual sessions, city groups and a dedicated conference have been requested and are duly stored in my backlog, but I prefer to take it step by step and see how the report and the new “insights from the data” episodes will be accepted.

Thank you

It remains a great joy to write this newsletter and build a platform to connect like-minded people. The opportunity to learn, think and write about innovation in VC right from the driver’s seat is a unique gift I do not take for granted. Thank you to all who read, support, enjoy and share this publication. There is a lot to do.

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

Thanks for bringing more transparency to an opaque and often times exclusive club. I love the way you add numbers to the narratives. Excited for 2023