👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 13,331, +216 since last week

Brought to you by Carta - Your Equity Management Solution

Carta is a platform that helps people manage equity, build businesses, and invest in the companies of tomorrow. Our mission is to unlock the power of equity ownership for more people in more places. Carta manages over two trillion dollars in equity for over two million people globally. The company is trusted by more than 38,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity, venture capital solutions, and more.

Last week, Data-driven VC turned 1.

Time has a peculiar way of distorting our perception; it feels as if this journey began merely last Thursday, and yet, there are moments when it seems a decade has passed. Nevertheless, there's an undeniable sense that Data-driven VC is still in its inception phase.

Zooming out, the last 12 months have, without exaggeration, been a crazy ride, and you, the Data-driven VC community, played a pivotal role. Some highlights:

Data-driven VC newsletter and my LinkedIn account surpassed 13,000 readers and 33,000 followers respectively

Writing forces me to sit down, condense my thoughts, and form way sharper perspectives than I would’ve otherwise been able to. Clarity of thought helps me to become a better investor and us at Earlybird to build a better product for our investors

I’ve been invited to a range of leading podcasts, conferences, and round table discussions to share my perspectives on AI, data, productivity, startups, and the Future of VC

I’ve met and collaborated with people I deeply respect and admire

Our community is full of some of the smartest, most thoughtful people I’ve ever met, and whom I want to be friends with IRL

Today’s piece reflects what has brought us to this point. In particular, we’ll discuss:

Origins. Why I started Data-driven VC.

Growth. How I attract new subscribers and create engagement.

Process. How I write one piece every week while working as a full-time investor.

Future. What does the next year hold?

Let’s jump right in.

Help me chart the road ahead by completing this super-easy, 2-minute survey. Not only will it give me invaluable feedback, but it ensures Data-driven VC is built with you, the reader, at its heart.

1. Origins: Why I started this newsletter

Having spent 6+ years as a researcher and investor with the question about the Future of VC and how data & AI can help us make the investment world more efficient, effective, and inclusive, I think I have had extremely lucky timing to turn my occasional Medium writing into this more structured newsletter in September last year.

Just two months later, the launch of ChatGPT - a product powered by LLMs with most likely the biggest disruption potential for any knowledge worker job we have ever seen - took this newsletter on a big wave that I did not anticipate. Suddenly, the sentiment shifted from “VC is more art than science” and “this craftsmen industry won’t be disrupted” to “how do you use LLMs” and “we can replace majority of an analyst’s job with AI”.

Trying hard to not drown but surf this wave, Data-driven VC quickly became the go-to source for investors looking for guidance, ideas, and room to exchange thoughts on their journey to leverage data & AI within their cotton industry. Moreover, it provides valuable insights for founders, operators, and everyone interested in startups.

Why did I start working on data-driven approaches in VC in the first place?

The below quote is taken from my very first episode “What to expect from this newsletter”:

When I first joined Earlybird VC as an intern in 2017, I had anything but a clue about what VC actually was. However, I had one clear - for me very obvious - expectation: Those who invest in and support the most disruptive businesses on our planet would certainly be most advanced in terms of processes, tools and tech stacks themselves. If you see and feel cutting-edge innovation day in and out, why wouldn’t you operate that way yourself? Well, to tell you I was disappointed on this one is probably a vast understatement.

In the beginning, I thought it was only Earlybird, but speaking to some peers at other firms I quickly realized that it was actually an overarching problem across the VC industry. In retrospect, having had Salesforce as a CRM system in 2017 made Earlybird actually stand out at that time. Anyways, the only “real” digitization that VC has ever seen was the transition from pen and paper to mouse and keyboard. Surprisingly, progress has stopped at the MS Office Suite (and Covid-induced video calls..) That’s (mostly) the state-of-the-art in VC.

So back to the initial question: Why this newsletter? Together with an ever-growing group of like-minded people, I made it my mission to push VC to the next level through real innovation. To overcome shortcomings from inaccessibility for underrepresented founders over biased, inefficient and manual decision-making processes to non-scalable, sometimes very limited value-add. I strongly believe that technology in general, but data more specifically, is here to disrupt VC as it did/does with any other industry.

These few lines exemplify my strong belief that VC as an industry was about to undergo a massive disruption fueled by data-driven approaches and AI. Ever since I started diving into the topic, I’ve met a diverse set of like-minded investors with similar thoughts, yet could find neither content nor a proper community to exchange thoughts more broadly.

Following my research and some interesting conversations around this topic, I decided to condense my thoughts into “The Future of VC: Augmenting Humans with AI” around three years ago. Your incredibly positive resonance proved that I hit a nerve.

Why did I start publishing my thoughts instead of keeping it to myself?

Why did I decide to share it with the world? These and many other related questions came up uncountable times. And the answer is simple. I’m a big believer in community and open-source approaches. Open source leverages the power of community to overcome individual constraints. It assumes that collective wisdom is more powerful than any one individual can ever be.

Data-driven VC is like an open-source project with an open-core model. It’s a fine line between creating a oneway all-embracing brain dump that people can just take to exactly replicate what we did at Earlybird versus publishing useful, deep-dive pieces that provide sufficient value for an audience to trigger a discussion that eventually creates more value for the community but also myself and our firm. Value and ideas that oftentimes go beyond what I had initially imagined.

How do I draw the line between what gets published and what stays part of the “secret sauce”?

There is no silver bullet but my simple line of thought is that as long as I expect someone to figure something out by spending a few weeks or months full-time on a specific topic, it’s likely no rocket science and can be published to trigger a deeper discussion.

After all, I started out without big expectations. At worst, Data-driven VC would’ve become a weekly diary to condense my thoughts and form sharper perspectives on some of the topics close to my heart. At best .. well, I had no clue ..

2. Growth: How I attract new subscribers and create engagement

At the time of writing, these are the Data-driven VC metrics:

13,331 subscribers across 136 countries

101.3k reads last 30 days

52.85% average open rate

So, how did that happen? It required a mix of consistency, experimentation, and serendipity.

Consistency

Whenever someone asks me how I’ve grown Data-driven VC, I’m always reluctant to share. Not because I have some closely guarded secret but because my advice is so banal. The best way to build an audience is to create something that people care about, consistently. If you do that and share your work, you will grow. It really is that simple, and that difficult. It might not be as fast as you’d like, and there are certain techniques that can steepen the slope, but without nailing these basics, you’re fighting an uphill battle.

Each component matters:

Creating something people care about. Following your incredibly positive feedback on my “Future of VC” Medium post together with some invitations to give keynotes about this topic, I knew there was something. Meeting an underserved need and creating something that people actually want is key.

Do it consistently. It’s very tempting not to create. Writing is effortful work, requiring a high cognitive load. There are so many more pleasurable things you could do in your free time instead - writing is sometimes just very painful and requires some true hustle.

To give you a feeling, I’m writing this article Wednesday to Thursday night 2.28 a.m. following some crazy busy weeks and having left Earlybird’s Annual Limited Partner meeting just a two hours ago .. with an alarm set at 4 a.m. to catch my 6 a.m. flight back to Munich 👀

It is not easy. But once you commit to a schedule, you need to show up. It’s a commitment to consistency. Setting a cadence forces practice, improving your work. It also helps readers perceive your writing as a product that can be relied upon.

Share your work. It’s hard to know what people want. The best way to figure it out is to share what you’ve created and get feedback. Use that to iterate and improve. Of course, without sharing your work, you also can’t hope to attract an audience. This is tricky to start with — it feels self-promotional because it quite literally is. Bit by bit, it becomes easier. Reframing sharing one’s work as beginning a conversation rather than asking for attention helps, too.

In a nutshell, the biggest reason Data-driven VC has grown is that I write something that some people like, reliably.

Experimentation and serendipity

Beyond all, you also need some luck. As mentioned in the beginning, the timing of this newsletter two months ahead of ChatGPT, a tool that serves as widespread evidence for the power of data & AI driving knowledge worker productivity, was pure luck. Of course, I’ve known about the power of LLMs before, yet I could not imagine getting such an attention boost.

There is a 0% chance of success if we don’t try, so it’s important to explore new stuff to at least get a chance of serendipity. Every once in a while, something you write about attracts sufficient attention to spike your growth.

What were the drivers of Data-driven VC’s audience growth?

Converting an existing followership. As many of you know, I’ve been quite active on LinkedIn for years. I had around 15k followers on the platform when I started this newsletter and thankfully more than a thousand of you subscribed right after launch. Today, the newsletter and my LinkedIn (+ also Twitter) accounts have become a reinforcing flywheel.

ChatGPT and the power of step-by-step guides. In the weeks following the launch of ChatGPT, uncountable people asked me how I liked it and how I imagined integrating it into my workflows. After repeating myself over and over again, I decided to write “10x Your Productivity with ChatGPT” to share my thoughts and show people how I started using the tool with a step-by-step guide. Within a week or so, I gained more than a thousand subscribers.

Guest posts. Community is at the core of Data-driven VC and one of the most exciting outcomes for me personally is the growing number of incredibly smart people who react to my writing and share their thoughts via comments or DMs. Some of their ideas were too interesting to keep for me, so I decided to selectively invite bright minds like Prof Dries Faems, Prof Isabel Welpe, Vlastimil Vodicka, Arnas Bräutigam, or Will Bricker to share their insights with our wider community.

Data-driven VC Landscape. Being quant by nature, I couldn’t stop with qualitative anecdotes to grasp the status quo of digitization in VC but collected a range of data points via a survey end of last year. The participation and breadth of insights exceeded my expectations, so it took some weekends to understand that this is much bigger. With the help of a few dedicated freelancers, I decided to put these learnings into a comprehensive report: The inaugural “Data-driven VC Landscape 2023” was born.

Given the work we put into the report, of course, I wanted to maximize distribution. Having seen a range of exceptional product launches from startups we invest in, I took an 80/20 approach to some of their most powerful launch strategies and published the report in early May. Some results:

Top 10 ProductHunt launches of the day (was #1 for many hours but ProductHunt confirmed a ranking bug that led to a sudden delisting on their homepage..) - Hope they get this fixed for our next launch in 2024 ;)

Close to a million social media impressions via LinkedIn and Twitter

10k+ sub-page visits with 4k+ Google search impressions

5k+ PDF report downloads with approx 50-70 new downloads per week

In a nutshell, growth was triggered by a mix of timely content (like the ChatGPT post) as well as more timeless content (like the Data-driven VC Landscape).

Distribution

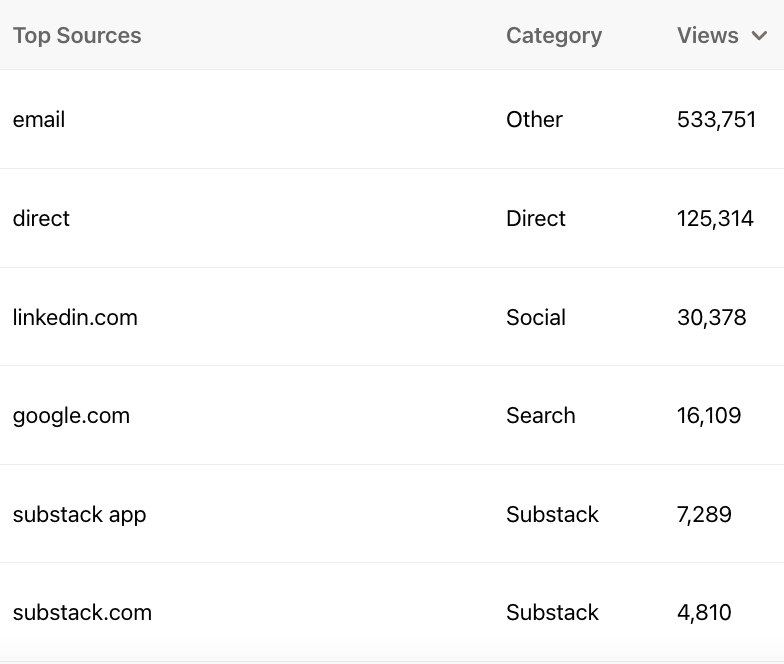

“Spend at least as long with distribution as you spend with creation”. This was not only true for the Landscape report but also for the newsletter itself. Data-driven VC received more than 700k views within the first year and the most successful channels are email (= subscribers), direct (= people type the URL directly), LinkedIn, Google Search, and Substack via the recommendation feature.

“Direct” via conferences, podcasts, and more. Walking the talk is critical to grow your audience. I’m thankful to be a Partner in one of Europe’s leading early-stage VC firms, regularly getting the opportunity to share my thoughts across conferences, podcasts, and other formats. Following the launch of this newsletter, I have received an increasing number of invites to share my thoughts and learnings around AI, data, dev, productivity, startups, and the Future of VC. As a result, “direct” traffic became an important pillar of growth for this newsletter.

LinkedIn and Social Media. Reposting your own work via Social Media might feel like uncomfortable self-promotion. Yet, if done right it’s one of the strongest growth levers. To not spam my LinkedIn and Twitter audiences, I post a concise summary including major takeaways right after the publication of each episode. Once a week, no more. Looking at the performance of these posts, I can say that both LinkedIn and Twitter clearly punish external content as they obviously do not like me to lure users away from their platforms. Still, it’s definitely worth it to grow your own audience. An audience that you own, not them.

Website. I started this newsletter on Substack and received the subdomain datadrivenvc.substack.com. Thankfully my friend

shared his thoughts about SEO and the importance of owning the traffic in case I want to move to another platform in the future. I bought datadrivenvc.io in March 2023 and paid 50$ for a Substack redirect.Looking at search traffic for the new website, one thing is clear: It’s a long-term game. 6 months in, we achieved more than 200k search impressions and over 10k clicks, both gradually increasing.

Substack Recommendations. In April 2022, Substack rolled out a new feature called “Recommendations” that allows writers to directly ensure each other’s publications. I love this feature as it plays into my strong belief in community. So, I’ve been a strong recommender from day 1, having generated approximately 3x in subscriptions for other writers than other writers generated for me. It’s all about giving :)

Help me chart the road ahead by completing this super-easy, 2-minute survey. Not only will it give me invaluable feedback, but it ensures Data-driven VC is built with you, the reader, at its heart.

3. Process: How I write one piece every week while working as a full-time investor

I’ve always done projects in parallel. Be it a dual degree program with an apprenticeship and a parallel Bachelor of Engineering degree or conducting a PhD program while working full-time in VC. The single most important lesson after parallelizing big projects for more than a decade is that routines and clear priorities are key.

Accountability. Isn’t it surprising that we make it on time to every business meeting but frequently skip our gym session? Studies show that as soon as we promise something to another person, accountability spikes. Therefore, I publicly committed to publish one episode every Thursday plus another monthly wrap-up at the end of each month. One year in, I missed zero.

Workflow. I learned throughout my PhD that different people have different writing behaviors. Personally, I love to collect ideas on the fly, block some time in my calendar, take the most suitable topic, split it into a rough agenda, write an article in one go, and leave some time to zoom out to then do a final grammar & typo review.

Toolstack. I wrote about my tool stack (Investor productivity stack, Knowledge stack, or my Plugin Stack) before so I’ll keep it short here: Finding the right tools to supercharge your content creation and distribution workflow is key. My stack looks like this:

Apple Notes to save my ideas on the fly

Notion to combine and structure thoughts into individual episode agendas

ChatGPT to create an initial draft

Grammarly for proofreading

Substack for publication

AuthoredUp! for LinkedIn formatting, distribution & analytics

4. Future: What does the next year hold?

Thanks to the early success of this newsletter, I not only received a broad range of invitations to speak at conferences, and podcasts, and contribute to other media formats, but also received exciting collaboration offers for a dedicated Data-driven VC podcast, a conference, a round table series, and a lot more.

While I deeply appreciate these kind requests and increasing interest in product additions, seeing all of these opportunities line up made it extremely difficult to stay focused. I wanted to create a healthy foundation before casting an eye on the next opportunity. One year in, I feel that now is a great time to explore the next step for Data-driven VC.

I’m currently evaluating the following additions and would love your feedback to prioritize.

If you’d like to be invited to the upcoming initiatives, feel free to fill in the reader survey and leave your email at the end. You’ll get exclusive access for sure!

Gratitude

I don’t know where Data-driven VC will be in a year’s time, but I know that I am extremely grateful for the year just passed. I can’t miss the opportunity to say thank you to everyone who has helped our community grow to reach this point. There is definitely more to come …

… and as French mathematician and philosopher Blaise Pascal already said: "If I Had More Time, I Would Have Written a Shorter Letter"👋🏻

Stay driven,

Andre

Thank you for reading. If you liked it, share it with your friends, colleagues, and everyone interested in data-driven innovation. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature an article, research, your tech stack or list a job, hit me up! I would love to include it in my next edition😎

Amazing write-up. Thanks for sharing your thoughts.

I began a data-focused newsletter a year ago and can relate to what you're saying.

Keep it going.

I'm lucky to play this great online game with you, Andre. So fun to see you grow. And I'm very fortunate to receive so many subscribers from you. You're as knowledgeable as you are generous!

Love how you called out the role of luck - you're right. You have to spread your surface area for good things to happen. And you do that by just showing up, week after week after week.

Congrats, and here's to another great year.